Survey Says: Research Shows Natural, Organic Channel Saw Steady Growth in 2021

This article originally appeared in Presence Marketing’s July 2022 Industry Newsletter.

By Steven Hoffman

Starting out in the natural and organic products industry in the mid 1980s as an associate editor with media and trade show company New Hope Network, there were a few long after-hours sessions spent each summer pouring over completed paper surveys sent in by retailers, and compiling data with company founder Doug Greene to analyze and publish what has since become a milestone marker for the industry, the Natural Foods Merchandiser’s Annual Market Overview Survey.

Photo Credit: Organic Trade Association

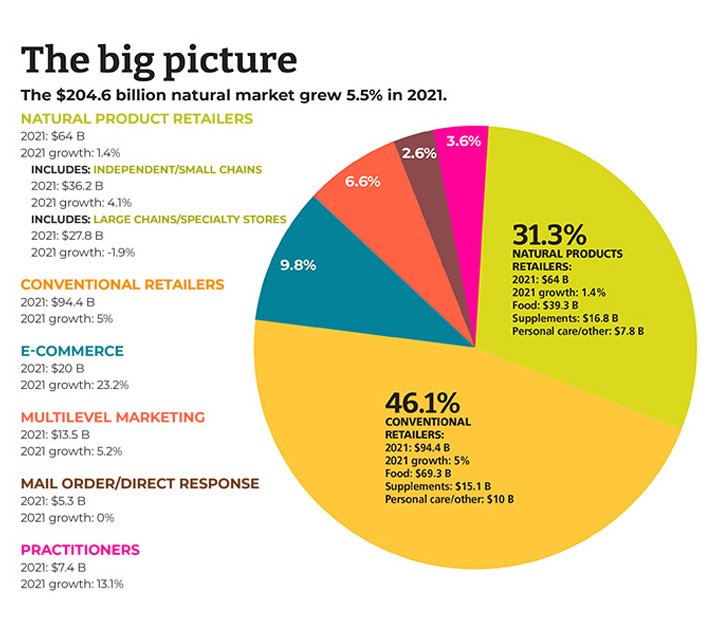

Today, the survey has become much more sophisticated, and so has the market, which has grown 10X since that time to reach $204.6 billion, representing an overall growth rate of 5.5% in 2021, according to this year’s report, published in June 2022.

Once dominated by independent natural products retailers, according to this year’s survey, conventional retailers now command 46.1% of natural products sales, representing growth of 5% in 2021. Combined, independent and large-chain natural products retailers comprised a market share of 31.3% in 2021. However, while independent natural products retailers recorded growth of 4.1%, the large chain and specialty store format saw sales decline by 1.9% in 2021.

Overall, conventional grocers reported natural products sales of $94.4 billion in 2021. Sales were $64 billion among natural products retailers in 2021, comprising independents, small chains and large chain/specialty stores. New Hope estimates there were 21,613 independent and large chain natural channel retail stores in the U.S. in 2021.

Of note, e-commerce sales of natural products continues to grab market share, charting growth of 23.2% in 2021. That’s not surprising, say industry observers, considering consumers were still spending considerable time at home in 2021 during the pandemic. Now, as the world emerges, some of those online consumer shopping behaviors may stick, according to Nutrition Business Journal’s 2022 Supplement Business Report, particularly when it comes to dietary supplement sales. According to NBJ, the supplement industry recorded $59.9 billion in sales in 2021, up from just $43.2 billion five years ago. E-commerce claimed the biggest share of post-pandemic dietary supplements sales growth, reported Rick Polito in the Natural Products Industry Health Monitor.

Photo Credit: Natural Foods Merchandiser 2022 Market Overview Survey, New Hope Network

Across all sales channels, e-commerce “is leading a huge shift in channel dynamics,” according to NBJ Senior Industry Analyst Claire Martin Reynolds. Based on a growth trajectory that is expected to add another $10 billion in dietary supplement sales over the next four years, “2024 is expected to be the record year where e-commerce market share in supplement sales is larger than natural and specialty or mass market retail, coming sooner than previously forecasted given the pandemic-related acceleration,” NBJ reported.

New Hope’s overview also revealed some interesting data regarding the demographic makeup of natural products shoppers.

While a common assumption is that natural channel shoppers are mostly white, well-off moms, that perception is inaccurate, said New Hope’s editors. “In fact, shoppers are fairly evenly divided along gender lines; fewer than half are Caucasian; about 40% are affluent; and more than a third live in households with just two people. Additionally, more than a quarter of natural channel shoppers are Hispanic and more than a third of Asian consumers are significantly more likely to shop at natural grocery stores; 36% of consumers who represent communities of color agree that products at natural retailers were, ‘made with me in mind’ (compared to 32% of all retail customers combined); and Hispanic and Asian consumers specifically are more likely than all natural retail shoppers to agree that they are ‘willing to pay a premium for natural and organic foods and products’ (44% vs. 36%),” New Hope’s researchers reported.

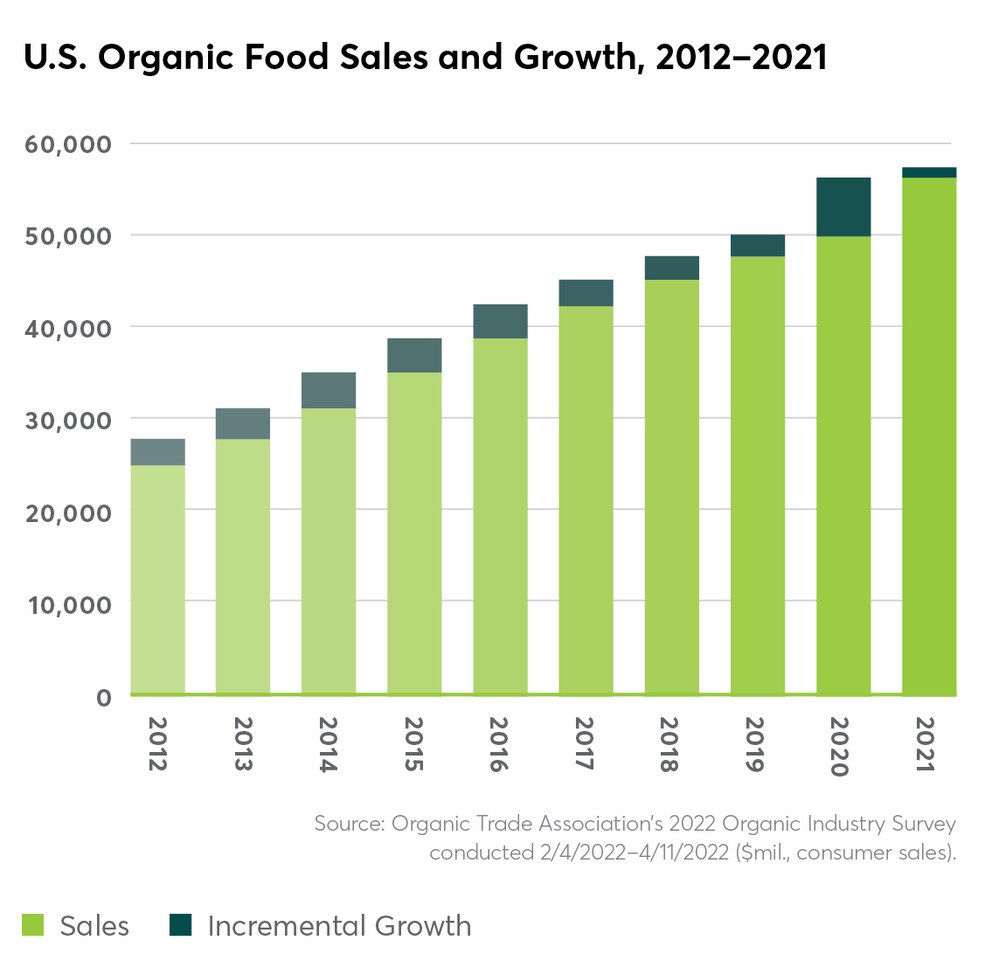

In related news, in its annual Organic Industry Survey, published in June 2022, the Organic Trade Association reported that between 2020 and 2021, sales of organic products surpassed $63 billion, growing 2% during that time period. Food sales, which comprises over 90% of all organic sales, rose 2% to $57.5 billion, and sales of nonfood organic products grew 7% to reach $6 billion in sales.

“Like every other industry, organic has been through many twists and turns over the last few years, but the industry’s resilience and creativity has kept us going strong,” said OTA’s CEO and Executive Director Tom Chapman, “In 2020, organic significantly increased its market foothold as Americans took a closer look at the products in their home and gravitated toward healthier choices. When pandemic purchasing habits and supply shortages began to ease in 2021, we saw the strongest performance from categories that were able to remain flexible, despite the shifting landscape. That ability to adapt and stay responsive to consumer and producer needs is a key part of organic’s continued growth and success.”

Among the strong performers in organic: organic beverages experienced the highest growth (8%) of all major categories, with organic coffee topping 5% growth and $2 billion in annual sales. Organic produce accounted for 15% of the organic products market, bringing in $21 billion in revenue in 2021, a 4.5% increase over 2020. Fresh produce drove growth in that category, at 6%.

While a decline in packaged and prepared organic food sales in 2021 represents a shift away from the pantry loading of 2020, organic baby foods — traditionally a strong entry point for shoppers new to organic — was a bright spot in 2021 with 11% growth. Organic snack foods, which suffered a decline in 2020, saw healthy growth of 6% in 2021, reflecting a return to active lifestyles and demand for healthy, nutritious on-the-go foods.

Among non-food organic products, fiber, supplements and personal care products were the most dominant performers with growth rates of between 5.5% and 8.5% in 2021, said OTA. Textiles, the largest non-food sub-category, represented 40% of the category’s total sales and brought in $2.3 billion in annual sales. Overall, non-food products saw 6% growth in 2021 and represented nearly $6 billion in sales, OTA reported.

However, industry observers caution that the unprecedented inflation the country is experiencing this year could affect sales of typically higher priced organic products as price-sensitive consumers opt for purchasing conventional foods to save money, according to a recent report in the Organic Produce Network. According to an Economist/YouGov poll taken in June 2022, 69% of Americans say changes in the inflation rate have impacted them negatively. In a June 2022 survey conducted by market research firm The Feedback Group, 24% of consumers are substituting similar, less expensive foods and 12% said they are buying fewer organic items and products to cut costs.

“Organic’s ability to retain the market footholds gained during 2020 and continue to grow despite unprecedented challenges and uncertainty is a testament to the strength of our industry and our products. To keep organic strong, the industry will need to continue developing innovative solutions to supply chain weaknesses and prioritizing efforts to engage and educate organic shoppers and businesses,” said OTA’s Tom Chapman.

Natural Retailers Share Strategies for Today’s Economic Headwinds

Photo: Pexels

This article originally appeared in Presence Marketing’s March 2022 Industry Newsletter

By Steven Hoffman

As the country and world emerge from the global COVID-19 pandemic, in 2022, the economy is now facing a new set of challenges, including food inflation, supply chain woes and rising energy and transportation prices costs. We asked a few retailers and others in the natural products channel to share some thoughts on how they are dealing with today’s business headwinds, and we are pleased to share their responses, below.

Ben Nauman, Senior Director of Purchasing, National Co+op Grocers (NCG)

National Co+op Grocers (NCG), based in Minneapolis, MN, is a business services cooperative for retail food co-ops located throughout the U.S. The organization represents 149 food co-ops operating over 200 stores in 38 states with combined annual sales of $2.4 billion and serving over 1.3 million consumer-owners.

- How are you retaining and recruiting talent and ensuring shifts are covered in a period where labor has been challenged?

Over the last few years we’ve greatly expanded our efforts to seek out diverse candidates for roles at NCG in alignment with our broader DEI (diversity, equity, and inclusion) initiatives. This has caused us to rethink many of our hiring practices and processes and these efforts are paying off. We’re increasingly sought out, we’re reaching new talent pools that we weren’t tapping into previously, and the mix of experience and skills we’re bringing into the company are both broader and deeper than what we’d seen previously. I’m amazed by the talent that we’ve seen join our team over the last couple of years!

At retail the “operative” has been flexibility. Our co-ops have been called on to be adaptive in the last twenty-four months like never before. They’ve had to shut down entire areas of the store, reconfigure them, introduce new programs, safety protocols, etc. Though it’s absolutely exhausting for our retailers, I’m continually impressed with how the leaders in these independent community-owned businesses have not only taken so much in stride, but also been leaders in keeping their staff and shoppers safe while keeping their community well-nourished. In some instances flexibility has meant reducing operating hours; in others it’s meant more flexibility in scheduling or the number of hours the team members work as they navigate child care, schooling, etc. As is the case across the retail landscape, some co-ops have had to make adjustments to their compensation and benefits packages in order to recruit and retain and job fairs and off-site recruiting events have become more frequent. Because so many co-ops pay a “livable wage” my suspicion is that some of the market forces at play haven’t negatively impacted our co-ops quite as much.

- How are you working with partners to relieve supply chain, transport and distribution issues and ensure the products your customers want are on the shelf?

As with the labor challenges, flexibility has been key and for this challenge I would add “communication.” Our Category Managers are in regular contact with brands about the challenges they are experiencing and our friends at top notch brokerages like Presence/Dynamic Presence are of great help. Our Supplier Programs Managers are meeting a few times each week with our distributors on their challenges, and our retailers are being transparent with their customers about the challenges. When we’re at our best, our retailers are solutions-oriented and reallocating shelf space, identifying new sources, and offering up alternatives to popular products that are out-of-stock. The biggest challenge has been in distribution, where we saw greatly diminished capacity in the fall of 2021 and this is especially tough because it hits so many product segments all at once. It has helped us immensely over the last year to have established a relationship with KeHE as a secondary supplier and our purchases from them have grown a few hundred percent in under a year.

- Are you noticing that severe weather and/or climate change is affecting your business in any way?

Aside from pricing volatility, especially in fresh Produce, we’ve seen mostly short-term impacts so far. We’ve seen severe weather (not sure that we can directly correlate climate change to these instances yet) knock out a supply chain or set back a manufacturer for periods of weeks to months, and also negatively impact the logistics network of the distributors we rely on.

- How do you see things improving on the horizon? How can the industry be proactive in the future?

Very slowly! I think we’re going to see elevated rates of out-of-stocks and a greater degree of volatility in the availability of resources, be they raw materials, packaging, transportation, etc. for quite a while. Though we saw some recovery in the late spring/early 2021, to even think of it as recovery was only relative to what we’d experienced over the course of the prior twelve months. And service levels were already a challenge for our industry before the start of the pandemic. What I think we can say with confidence after what we’ve seen over the last two years is that consumer interest in natural, organic, and “better for you” products is only going to continue growing. We saw a lot of conventional/mass market retailers jump off the bus in 2008 with the downturn in the economy, which was good for our business. Nearly two years in now demand remains at sustained elevated levels and the industry can’t keep up.

Fairly early in the pandemic, when it seemed obvious that available historical data was of limited utility, I saw a lot of organizations try to leverage available “intelligence” from field experts on what they were seeing. This seemed to be a real positive and I think was critical to helping many in our industry adapt to the shifts in demand and consumer behavior we were seeing. Where I think we’ve stumbled is to create any sort of enduring roundtable or dialogue among industry leaders about how we can address some of the more intractable or systemic issues we’ve seen as it seems like we’ve largely shifted our focus back to what we needed to do to ride out this storm in our own businesses. It’s also surprising to me that we’ve not been quick to adopt more technology given all the uncertainty. How is it possible that I can order a pair of swim-trunks and know where that shipment is at nearly every stop en route to me, but when it comes to a $20K multi-pallet order from the largest food distributors in the country I’m in the dark until it hits my dock?! This has to change.

- Are you there any other comments, observations or thoughts you would like to share?

The one thing that you didn’t ask about but might have, considering what is occupying the focus and attention of so many in our industry right now, is food inflation. Though inflation made headlines for nearly 2/3 of the year last year without really hitting supplier’s invoices (outside of animal proteins), over the last few months we’re seeing price increases like nothing we’ve seen in my time in the industry. This has meant that not only do merchants need to adapt to ever-changing public health guidelines, supply conditions, and a challenging market for talent, but they’ve also got to be on top of their pricing game like never before. We understand entirely the need for many manufacturers to increase their prices to us given the increased costs many have seen, but what has really impressed me over the last few months is the number of manufacturers who have not just increased their prices, but who are also working with us to mitigate some of the cost increases through strategic pricing investments tied to improved distribution of their products. I think the brands that are not just thinking “cost recovery” but are playing the long game in partnership with retailers will prove themselves to be the winners.

Alan Lewis, Director of Government & Industry Affairs, Natural Grocers

Founded in 1955 as a door-to-door sales operation by Margaret and Philip Isely, Natural Grocers, based in Lakewood, CO, today a publicly traded company with 162 stores in 20 states.

- How are you retaining and recruiting talent and ensuring shifts are covered in a period where labor has been challenged?

Even though we operate on slim retail margins, we keep our wages and benefits competitive. We also want full time employees with health insurance and other benefits. In the midst of the fragile gig economy, having a real job with a supportive employer is very appealing.

- How are you working with partners to relieve supply chain, transport and distribution issues and ensure the products your customers want are on the shelf?

We are in constant communication with vendors and distributors to balance incoming deliveries to keep shelves filled. If a store is demanding one exact SKU and only that SKU, they may end up with empty shelf slots for extended periods. Being flexible with short term substitutes keeps customers content, and we can use it to test new products or versions until regular deliveries resume.

- Are you noticing that severe weather and/or climate change is affecting your business in any way?

Weather has always been a challenge in global logistics, and the industry continues to adapt to increasingly severe events. For growers, we hear that unexpected crop failures due to wind, fire, flood hail and drought are happening more often than in the past. Many times, organic farms fair better during these events than conventional industrial monoculture. That's reassuring. It has seemed to get harder to source substitute ingredients to cover random shortages. However, everyone is wide awake to climate change mitigation at this point.

- How do you see things improving on the horizon? How can the industry be proactive in the future?

We know farmers who manage ten thousand acres, but those acres are never contiguous or planted with the same crop. To hedge against climate and the market, they are all about diversifying on all levels to lower their overall risk. In the same way, natural products retailers need to become agile: know what alternatives are available and nurture relationships with multiple sources. Emphasize products that are less likely to be harmed by logistical, political, weather, and disaster events. Begin educating customers that some once-reliable offerings may become available only occasionally.

- Are you there any other comments, observations or thoughts you would like to share?

Our customers are well aware of all the challenges we face. The more we communicate transparently with them, the greater understanding and patience people have. It also motivates them to change their purchase choices to support resilience and food security. It's not someone else's problem any more -- it's all of ours.

Justin Jackson, COO, Jimbo’s Natural Foods Grocer

With four stores and strong ties with local organic farmers and natural food vendors, Jimbo’s is the leading independent natural foods retailer in San Diego County, CA.

- How are you retaining and recruiting talent and ensuring shifts are covered in a period where labor has been challenged?

In all honesty, it hasn’t been possible to fully address some of the staffing needs. It has gradually improved over time as more and more people appear to have decided to rejoin the workforce. With that said, we have taken steps to show our staff how much we value them by increasing their wages, continually showing our appreciation for the work they do, increasing their bonus potential, having food truck lunches at least once a quarter and thanking them every day for all that they do and have done each day to make Jimbo’s a place where our community wants to come and spend their time.

- How are you working with partners to relieve supply chain, transport and distribution issues and ensure the products your customers want are on the shelf?

Biggest thing here is communication and a continuing commitment to our producer and vendor partners. Our Merchant Team spends a great deal of time trying to get ahead of issues so that we can mitigate problems as much as possible when they arise. We have also fully encouraged our folks to get products from whomever we can if our primary is out of stock. If it isn’t on the shelf we can’t sell it. The best plan is to have a plan B!

- Are you noticing that severe weather and/or climate change is affecting your business in any way?

What severe weather—we are in Southern California---it is about 75 degrees today 😊. This has not been a significant issue as of yet. There have been some shorts here or there and seasonality has moved in a few cases. But where this ends up will likely come into a much clearer focus in the years ahead. We recognize that this is a critical national issue.

- How do you see things improving on the horizon? How can the industry be proactive in the future?

We believe very much in what we do and remain committed to continuing to drive a conversation on how what we do impacts the environment around us. When I say the environment, that truly means the ecological environment.

- Are you there any other comments, observations or thoughts you would like to share?

We remain committed to Natural and Organic and we are now putting an emphasis on Regenerative Organic: taking our commitment to sustainability a step further! Our ask would be for the industry to continue to move in the same vein.

Gabe Nabors, CEO, Mustard Seed Market

Founded in 1981 by Philip and Margaret Nabors, Mustard Seed Market is the largest locally owned natural products retailer in Ohio. With the company since 2001, Gabe Nabors serves as CEO for the family-owned business.

- How are you retaining and recruiting talent and ensuring shifts are covered in a period where labor has been challenged?

You have to start with the basics: treat people well and be competitive on pay rates. After that it’s all about building a team environment. Cross train, update your team on sales but especially when they are doing well. It’s about creating a positive environment when we all know we are down people. We buy random lunches for all staff at our stores on big sales days or after holidays, for example.

- How are you working with partners to relieve supply chain, transport and distribution issues and ensure the products your customers want are on the shelf?

You have to be diligent on checking multiple suppliers and eat margin sometimes and order from the higher cost distributor or make the tough call to replace the item with another one that is in stock. The worst thing you can do is leave a tag up and it’s continuously empty.

- Are you noticing that severe weather and/or climate change is affecting your business in any way?

Yes, the key is to order extra heavy on key items before the storm hits.

- How do you see things improving on the horizon? How can the industry be proactive in the future?

I expect things to get better with supply chain but our cost increases are skyrocketing and that’s my biggest concern. I am personally getting more involved on the buying side with my team which is an area I typically had little involvement in.

- Are you there any other comments, observations or thoughts you would like to share?

Stay positive and remember, as a leader you are always on stage. Instill positivity and be solution oriented with your team.

Debra Short, Executive Director, SENPA, and Mari Geier, Co-owner, Nuts and Berries Healthy Market (SENPA Member)

SENPA, the Natural Industry Alliance, is a non-profit organization based in New Port Richey, FL, with a focus on strengthening the success of independent natural retailers and aligned manufacturers, and a leading voice, supporter and advocate for the natural-products industry. With two stores, Nuts and Berries Healthy Market has served the Atlanta, GA, area since 1980.

“We shared your questions with our retail board and they were in agreement that it is a challenging environment in the independent natural products retail store these days. For the most part, our retail membership is experiencing staffing issues across the board. The baby boomers of our industry are finding an extended work schedule at their stores, and with companies embracing the opportunity to visit stores once again, to continue product education there is still a gap to recruit and educate any new staff member. We see a strong need for our membership to network with their peers, and based on recent surveys, our retail membership is asking for more business seminars and tools to help with the trying times. The SENPA Business Summit at SOHO Expo and SOHO Healthfest focus on addressing those needs with our retailers.”

- How are you retaining and recruiting talent and ensuring shifts are covered in a period where labor has been challenged?

This is the million-dollar question, isn’t it? First, we pay a livable wage. We are a small enough business to understand how increase one employees base pay by $2-4 per hour would impact our bottom line and so we strategically raised prices on a few of our highest moving items by $0.50 to $1.00 to fund the increase. Then we treat our employees well. That seems like common sense, but we don’t look at our employees as assets, but rather like family. So, when they need help with something in their life, we use any and all resources we have to help them. From helping them get new tires on their car to supporting them when they are sick. And beyond this, we are always hiring because as good as we are, the younger generation is always looking for their next job.

- How are you working with partners to relieve supply chain, transport and distribution issues and ensure the products your customers want are on the shelf?

We start by stocking manufacturers that support independent stores. That helps us to develop relationships with the people running those companies. Those open lines of communication are key during these ever-changing times. We also make sure to keep several companies for each of the top movers so that if one company runs out of stock, we have a backup. Also, we sell a lot of local products (over 1000 between over 100 vendors). This allows us to circumvent many of the supply chain issues.

- Are you noticing that severe weather and/or climate change is affecting your business in any way?

We are in the Southeast, so not as much as some other parts of the country. But when there are delays due to weather in the northeast, that often impacts shipping times, and our products are delayed. We have overcome this by knowing where our vendors are located and paying attention to what’s happening in their neck of the woods. If there is a big storm in the pacific northwest, then we stock up for 3 weeks instead of 1 week worth of inventory.

- How do you see things improving on the horizon? How can the industry be proactive in the future?

I think the silver lining of these supply chain issues are the improved relationships we have developed with our key suppliers. Things will improve, but that may take a while. Many of our vendors have developed streamlined ways to communicate products as they come back in stock, so our buyers know to order. But most importantly, manufacturers need to remember that it is the independent retailers that often drive trends and supporting independents by giving them equal access to product and sometimes priority over big box stores will keep the roots of the natural products industry fueled.

- Are you there any other comments, observations or thoughts you would like to share?

As independent retailers, we have to support the suppliers that have been there for us through the past several years. Those that made getting us product their priority. Many have not and we can reward those that did support us with our loyalty.

Jan Chernus, SVP of Sales, Bob’s Red Mill Natural Foods

Employee-owned Bob’s Red Mill, based in Milwaukie, OR, is a leading provider of natural and organic cereals, grains, baking mixes and related products. The company was founded in 1978 by Bob and Charlee Moore.

- How are you retaining and recruiting talent and ensuring shifts are covered in a period where labor has been challenged?

We work hard to attract and maintain great employees. Not only do we offer very generous compensation and benefits, but we also operate as an ESOP – Employee Stock Ownership Plan. That allows all eligible employees to have additional retirement benefits above their 401k plan. We promote recognition for great work, a greener work environment, a cause that matters – the manufacture and sale of healthy, natural foods, healthy lifestyles and lifelong friendships.

- How are you working with partners to relieve supply chain, transport and distribution issues and ensure the products your customers want are on the shelf?

Constant communication with suppliers and customers is important to keep the business moving forward during challenging times.

- Are you noticing that severe weather and/or climate change is affecting your business in any way?

Yes, many commodities have been impacted by drought, especially oats. Last year’s oat crop came in much lower than expected.

As Supply Chain Problems Persist, Grocery CEO Predicts Food Prices Will Surge 10% in Next 60 Days; Meanwhile, Conventional Food Prices Are Catching Up to Organic

Photo: Pexels

This article originally appeared in Presence Marketing’s November 2021 Industry Newsletter

By Steven Hoffman

As the backlog of shipping containers at U.S. ports continues, Americans could see shortages of products across the country that will persist into the holidays, analysts are cautioning. Adding to the backup at the ports are driver and labor shortages across all channels of distribution. As a result, shoppers are again facing empty shelves, with pet food, diapers, frozen dinners, spices, chicken and other items listed as being in short supply in the nation’s grocery stores.

In addition to product shortages, food prices could increase 10% in the next two months, predicted John Catsimatidis, president and owner of the supermarket chains Gristedes and D’Agostino Foods.

The billionaire grocer told Fox Business that leading food companies will begin to prioritize products and raise prices. “I see food prices going up tremendously,” he told Maria Bartiromo on Mornings with Maria. “[CEOs] want to be ahead of the curve and the way they’re doing it is they’re dropping all promotions. They are dropping their low-moving items.”

Projecting a 10% price increase in the coming weeks, Catsimatidis said the trend won’t be ending “anytime soon,” as companies make more profits. “Why give away something when you don’t have to give it away and you make more margin?” he asked rhetorically. “So, I think that now these companies are going to have record profits in the third quarter,” he told Bartiromo.

According to the New York Times, Thanksgiving 2021 “could be the most expensive meal in the history of the holiday…Nearly every component of the traditional American Thanksgiving dinner, from the disposable aluminum turkey roasting pan to the coffee and pie, will cost more this year, according to agricultural economists, farmers and grocery executives,” writes food reporter Kim Severson. “Major food companies like Nestlé and Procter & Gamble have already warned consumers to brace for more price increases,” she reported.

Organic Food Prices Holding the Line More than Conventional…for Now

Meanwhile, researchers at Magnify Money, a division of Lending Tree, reported that conventional food prices are rising at a “much faster rate than organic costs.” According to its research, since 2019, prices for select conventional meats, dairy items, fruits and vegetables have increased by an average of 13.9% – 12 percentage points higher than the reported 1.6% growth in costs for comparable organic items.

Despite rising conventional food prices, organic foods on average remain more expensive, the Magnify Money researchers pointed out. However, they said, “For those organic-preferring shoppers, the good news is the costs of organic produce, dairy and meats are rising slower than conventional foods.”

However, while organic prices may not be rising as fast as conventional products, the $56 billion organic food industry also is grappling with a shortage of shipping containers and a tight labor market. One organic commodity being affected by the backup at U.S. ports is organic soybeans, much of which is imported into the U.S. in shipping containers, reported Reuters. Costly organic soybeans and higher priced organic products are fueling food inflation “at a time consumers are eager to eat better and focus on health during the COVID-19 pandemic,” Reuters reported.

Bell & Evans – a 127 year old chicken producer based in Pennsylvania – feeds 500,000 to 600,000 organically raised chickens each week, and must compete for soybeans with other buyers that formerly relied on imports, owner Scott Sechler said. The company raised all chicken prices in July and will likely need to raise organic prices again, he told Reuters. "We're in the most challenging time since the organic world started when it comes to feeding animals and selling an organic animal protein. It's a madhouse now. There's not enough in America to replace all the imported organic grain," Sechler said.

U.S. sales of organic food jumped by 12.8% in 2020 to $56.5 billion, compared with a 4.6% increase in 2019, according to the Organic Trade Association. Organic accounted for 5.8% of food sales in 2020 as the pandemic motivated consumers to eat more meals at home and focus on products perceived to be healthful, OTA said.

Retailers, Consumers and Manufacturers Are Beginning to Hoard Products…Again

While food and consumer product shortages are not as acute as they were in the early days of the COVID-19 pandemic, industry analysts are reporting that shoppers are beginning to hoard products, again. That, combined with ongoing supply chain problems, and retailers and food producers alike are planning for shortages to last into the near future.

In an interview with Spectrum News’ Bay News9 in Clearwater, FL, natural foods retailer Nature’s Food Patch General Manager Sean Balsley said some products have been hard to find, so when items in demand for the holidays are available, he buys extra. “You got to take it when you can get it,” he said, noting that some popular items for Thanksgiving have been difficult to order.

Adnan Durrani, CEO and founder of Saffron Road, producer of a popular line of natural frozen and shelf-stable foods, told Bloomberg that the company is holding onto extra inventory, keeping four months of supply in stock instead of one or two months of inventory normally held in past years. “People are hoarding,” Durrani told Bloomberg. “What I think you’ll see over the next six months, all prices will go higher.”

Food Prices Increased 4.5% in September Alone, Compared to 2020

Prices for food consumed in the home increased 4.5% in the month of September 2021 alone, compared with prices in the same month in 2020, as input costs continue to rise and more companies pass these costs on to consumers, reported The Food Institute. The question, the Institute asked, is how far can major brands push shoppers on price before they choose cheaper alternatives, search for lower cost brands, or reduce the number of items they purchase.

According to data from the Consumer Price Index, Fox11 News in Los Angeles reported that food prices increased 4.6% in the year since September 2020. Meat prices rose 12.6%, seafood prices increased 10.7% and categories including fruit, vegetables, cereals, bakery items and non-alcoholic beverages all charted significant prices increases in the past year.

Labor shortages in the supply chain are greatly responsible for price hikes, claimed Nate Rose, Senior Director of Communications for the California Grocers Association, in an interview with Fox11 News. Rose noted that labor shortages lead to reduced supply and increased prices. “People are seeing some more significant upticks in their food costs, especially around meat, year over year…It’s a tough one because demand is strong and right now producers are struggling to meet the demand because of short labor,” he said. “There’s been a lot of coverage of the situation at the ports but it’s also the shortage of truck drivers and people at the distribution centers. It’s tough to see these prices climb continually and I know people are feeling that in their pocket books,” Rose said.

In an interview with ABC Eyewitness News, U.S. Transportation Secretary Pete Buttigieg acknowledged the shortage of truck drivers, exacerbated by the fact that many drivers are older and few young people want to enter the field. He said the Biden administration is taking steps to streamline the process by which prospective drivers can obtain commercial vehicle licenses.

"The more red tape we can cut out of the process of getting those (commercial driver licenses), the more we can get drivers on the road, and make it possible for them to add to our supply capacity," Buttigieg told ABC. "But I should also be blunt: truck driving needs to be a more well-compensated and more respected profession. Look at the turnover margins in trucking. In large companies it can be 90% turnover per year,” he said.

Inflation Approaching a “Tipping Point at the Grocery Store”

Heading into the holidays, product shortages and purchase limits from major food and consumer product manufacturers "will be a challenge in the grocery industry" in the final months of the year, Steve Howard, VP of Merchandising for Bristol Farms, a leading California-based specialty grocery chain, told CNN. Suppliers are warning the retail chain of "potential shortages" of food products, glass jars and packaging containers, he said.

CNN reported that approximately 18% of beverages, 15% of frozen foods, 16% of snacks, 15% of candy and 18% of bakery items were out of stock at stores during the week ending Oct. 3, 2021, according to data from market research firm IRI, which tracks in-stock levels at leading U.S. grocery chains, big box stores, pharmacies and wholesale clubs. Before the pandemic, IRI reported that 7% to 10% of products were typically out of stock on shelves, according to CNN.

In response to a tighter supply as the country heads into Thanksgiving, Howard told CNN that Bristol Farms is working to bring in inventory "earlier than any other holiday ever," he said.

Noting that inflation may be “approaching a tipping point at the grocery store,” the Wall Street Journal reported that, as a rule of thumb, price increases above 5% are difficult to implement without resulting in changing consumer buying patterns.

Jamie Court, president of Consumer Watchdog, shared people’s concerns about across-the-board price surges. In a Fox11 News interview, she said, “The price of everything we need is up. The gas, the food, and the reality is we don’t know if it’s going to be short term or long term.”

# # #

Steven Hoffman is Managing Director of Compass Natural, providing brand marketing, PR, social media, and strategic business development services to natural, organic, sustainable and hemp/CBD products businesses. Compass Natural serves in PR and programming for NoCo Hemp Expo and Southern Hemp Expo, and Hoffman serves as Editor of the weekly Let’s Talk Hemp Newsletter, published by We are for Better Alternatives. Contact steve@compassnaturalmarketing.com.

Amazon’s to Open Whole Foods Market Stores Featuring Cashierless Technology

Photo: Wikimedia Commons

This article originally appeared in Presence Marketing’s October 2021 Industry Newsletter

By Steve Hoffman

Whole Foods Market announced on Sept. 8, 2021 that it will open two stores featuring Amazon’s “Just Walk Out” cashierless technology as an option for customers. The stores, expected to open in 2022, will be located in Washington, D.C.’s Glover Park neighborhood and in Sherman Oaks, CA.

According to Whole Foods Market, by using Just Walk Out technology, customers can enter, shop for the items they want, and simply exit the store. Those shopping using Just Walk Out will also have the option to use Amazon One, a fast, convenient, contactless way for people to enter, identify, and pay. If customers prefer, they can also opt to shop using self-checkout lanes or check out at the customer service booth with Whole Foods Market Team Members, the company said.

In a news announcement posted on Amazon’s website, Dilip Kumar, Amazon's VP of Physical Retail and Technology, said the company has engineered its Just Walk Out system, which relies on computer vision, sensor fusion and deep learning, to Whole Foods’ services and assortment. “Customers at these stores will be able to shop stations with self-service fresh-squeezed orange juice and mochi ice cream, while still shopping with the Just Walk Out experience and without adjusting any shopping habits,” he wrote.

“By collaborating with Amazon to introduce Just Walk Out Shopping at these two Whole Foods Market stores, our customers will be able to shop for fresh, thoughtfully sourced products that all meet our unparalleled quality standards, receive exceptional service from our Team Members throughout their shopping trip, and save time by skipping the checkout line,” said John Mackey, Co-founder and CEO of Whole Foods Market.

Though the new cashierless system offers the prospect of labor savings, Kumar noted that the stores using the Just Walk Out system “will employ a comparable number of Team Members as existing Whole Foods Market stores of similar sizes. With Just Walk Out-enabled Whole Foods Market stores, how Team Members in the store spend their time is simply shifting, allowing them to spend even more time interacting with customers and delivering a great shopping experience,” he said.

FMI Survey: 80% of Food Retailers Say Hiring Issues Are Hurting Business

Photo: Pexels

This article originally appeared in Presence Marketing’s October 2021 Industry Newsletter

By Steve Hoffman

Eighteen months into the COVID-19 pandemic, 80% of food retailers surveyed by the Food Marketing Institute (FMI) said difficulties attracting and retaining employees is having a negative impact on their businesses. In its report released Sept. 15, 2021, The Food Retailing Industry Speaks 2021, 42% of retailers surveyed also indicated that supply chain disruptions continue to hurt their businesses. These constraints are happening at the same time that consumer demand for groceries increased 50% in the last year, resulting in unprecedented 15.8% growth in same-store sales, said FMI.

FMI’s 2021 survey represents over 38,000 food retail stores. The survey also found that 95% of food retailers with e-commerce options experienced an increase in online sales in 2020 as a result of changes in consumer behaviors related to the pandemic.

“The pandemic transformed almost every aspect of the food retail industry – from the way consumers shop for groceries and consume their meals to how food is grown, produced and transported to supermarket shelves, to our ability to staff our stores and serve our communities,” said Leslie Sarasin, President and CEO of FMI. “Throughout the past year and a half, the food retail industry has been adapting to meet the shifting needs of the communities they serve. This year’s ‘Speaks’ report outlines the resilience and transformation of the food retail industry amid the COVID-19 pandemic and examines the proactive strategies and investments retailers have made to adapt to the changing food retail landscape.”

“Frontline workers have been lauded as heroes in the face of the pandemic, but recruitment and retention became growing challenges as turnover rose sharply. Retailers have pursued many strategies to resolve these challenges, including increased wages and benefits, flextime and training/skills development”, FMI outlined in a 10 Key Takeaways summary excerpted from the retail report.

Regarding supply chain challenges, FMI said, “Perhaps more than ever before, supply chain is front and center in food retail. Pandemic shortages have led retailers to reassess their supply chains and their engagement strategies with trading partners. Trucking and transportation capacity represents one of the biggest hot-button issues, with some two-thirds of responding retailers saying it is having a negative impact on their businesses.”

Is Organized Crime Responsible for Shrinking Retail Margins and Higher Prices?

Photo: Pexels

This article originally appeared in Presence Marketing’s October 2021 Industry Newsletter

By Steve Hoffman

The answer is yes, according to Kroger CEO Rodney McMullen. McMullen told investors in a quarterly results call on September 10 that its gross margins decreased by 0.6% – and that approximately 25% of that decline was due in part to loss of inventory, or what retailers refer to as shrink. “That's heavily driven by organized crime or at least it appears to be,” McMullen said of the shrink factor, according to the Cincinnati Business Courier. “And I know Congress and other groups are starting to spend more time on understanding what's driving that and what's behind it and what's the distribution channels for the stolen products, as well, and trying to manage that,” McMullen said.

As a result of rising levels of theft, higher supply chain costs and increasing food prices overall, McMullen shared that the grocery chain will raise food prices 2% to 3% this year.

Mark Matthews, VP of Research, Development and Industry Analysis for the National Retail Federation (NRF) told the Cincinnati Business Courier that the organized crime Kroger referred to is not necessarily something involving the “mafia,” but instead comprises organized gangs of people stealing from stores, delivery trucks, warehouses and elsewhere for cash, and it’s a growing trend, he said.

According to NRF’s most recent security survey, 69% of retailers responded that they has seen an increase in organized retail crime. Earlier this year, Home Depot reported that it is using technology to try to curb what it said has become a crime problem as the cost of lumber skyrocketed during the pandemic. Kroger said it is working with trade associations to try to fight the amount of product theft the company is currently seeing.

Tackling food fraud, estimated to cost the food industry as much as $40 billion a year in lost sales, product recalls and legal bills, especially during the pandemic, has been challenging because of complex supply chains and the fact that products can change hands numerous times before they reach supermarket shelves, reported Bloomberg. Cases tagged as fraud, adulteration or authenticity-based jumped 38% in the fourth quarter of 2020, compared to the previous year, reported U.K.-based Food Forensics.

The pandemic has complicated efforts to crack down on such criminal activity, as police resources have been diverted and online marketplaces and delivery platforms are creating more opportunities for illegal goods to be sold, Kimberly Carey Coffin, Global Technical Director at Lloyd’s Register, shared with Bloomberg.

“We are as busy as we have ever been, particularly with white flaky fish, tomatoes, rice and other core commodities that are usually vulnerable to fraud,” Rick Sanderson, Business Development Director of Food Forensics, told Bloomberg.

In examples of the growing problem, the Associated Press (AP) reported in mid-September that four people were arrested on suspicion of stealing nearly $2 million worth of retail products from 43 different stores across California. Investigators found the merchandise the theft ring had stolen stacked “floor to ceiling” inside a mobile home and multiple storage units. In April 2021, police arrested two men and recovered nearly $1 million in goods stolen from grocery stores, AP reported.

Market Overview: Pandemic Boosts Natural Products Sales 12.6% in 2020

Photo: Natural Foods Merchandiser, New Hope Network

This article originally appeared in Presence Marketing’s October 2021 Industry Newsletter

By Steve Hoffman

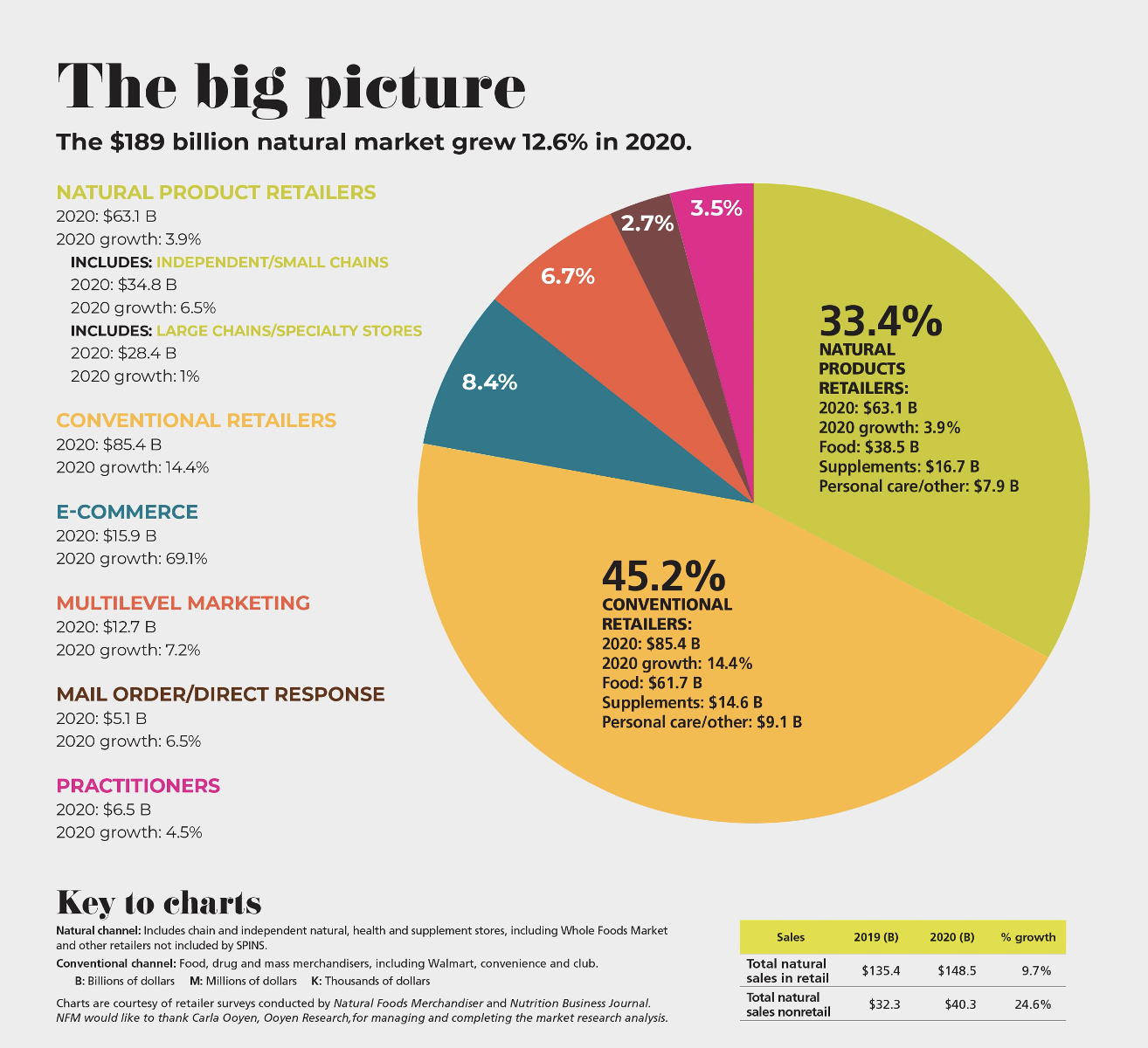

Many of the changes independent natural foods retailers adopted during the pandemic, such as digital ordering, curbside pickup, click-and-collect capabilities, traffic flow changes and more, may better help them compete going forward, writes Mark Hamstra in New Hope Network’s 2021 Market Overview Survey. And while natural foods retailers, like retailers everywhere, saw a decline in traffic, the uptick in basket size more than made up for it.

The average sales gain in 2020 among independent retailers surveyed was 6.5%, compared to 1% growth for large natural products chains. In particular, conventional retailers experienced 14.4% sales growth in 2020, and online retailers saw a whopping 69.1% sales growth in 2020. Of note, sales of natural products among health practitioners grew 4.5% in 2020.

Overall, the natural products market, estimated at $189 billion, grew 12.6% in 2020. Product categories leading the growth included meat, fish and poultry, condiments, dairy, fruit and vegetables, breads and grains, packaged/prepared foods and vitamins.

Natural Products Leaders Share their Outlook for 2021

Photo: Pixabay

This article originally appeared in Presence Marketing's January Newsletter and New Hope Network's IdeaXchange

By Steven Hoffman

If hindsight is 2020, then it’s anybody’s guess what 2021 will bring. And yet, that’s exactly what we asked these natural and organic products business leaders. Because if we can’t learn anything from the tsunami of the year that was 2020, then what’s it all for, one might ask? Read on to help prepare for a coming year of challenge and opportunity.

The Natural Industry is Primed to Serve – Russ Forester, SVP, Analytics and Insights, Hain Celestial Group

Russ Forester is an 18-year veteran at the Hain Celestial Group where, as SVP of Analytics and Insights, he provides category management expertise and consumer insights to help drive the company’s growth strategy. The publicly held company, with more than $2 billion in annual sales, owns a number of leading natural and organic brands, and has benefitted from the pandemic-driven shift to at-home eating and the consumer’s renewed focus on health and wellness.

“This past year, we’ve seen a shift to e-commerce, but where we’re really seeing the growth is not in ship-to-home from UPS or FedEx, for example. It’s coming from ordering from local grocers; sales are shifting 10-15% to this model, whether it’s curbside pickup or Instacart-style delivery, even to the point where certain retailers’ in-store sales may be down, but when you add in the online ordering channels, the overall sales are growing,” Forester observed.

“To paraphrase the CEO of Instacart, what we thought would take five years of adoption rates happened in five weeks. The pandemic, while creating a financial crisis, is driven by health concerns, and our industry is primed to serve that. Food is medicine, and products with a functional or immunity benefit, such as the wellness tea category, are doing very well,” he said.

Forester noted that premium brands are doing well across all income levels. “People are not traveling or dining out as much, so they are treating themselves to premium food at home. For those who are doing well, they’ve got more disposable income. We’re also seeing lower income shoppers are increasing their dollars in premium products. People are trying to find new ways to keep their families fed and healthy,” he added.

For smaller brands, the pandemic has created greater challenges for product discovery. “How do you use marketing tools today to create trials?” Forester asks. “Traditional methods of trade and promotions may not be as impactful, making it harder to break out. It may be best to reach consumers through digital outreach,” he advises.

“Our industry has always looked to the health and wellness of consumers and the planet. The pandemic has brought health and immunity to the forefront, and it’s mainstreaming the natural and organic industry more than ever before…in a good way,” Forester said.

Back to the Future – Steve Hughes, Co-founder and CEO, Sunrise Strategic Partners

As Co-founder and CEO of Sunrise Strategic Partners, Steve Hughes guides investments in such leading healthy lifestyles brands as Vital Farms, Maple Hill Organic, Coolhaus Ice Cream, Kodiak Cakes, Little Secrets, Teton Waters Ranch, Pact, Kill Cliff and Califlor. The unprecedented pandemic has created a portfolio-wide inflection point for the company. “We sell eggs, milk, pancake mixes, comfortable clothing you buy online…we’ve seen some extraordinary acceleration in our portfolio – from growth of 50% over the past three years, the Covid-19 pandemic has added about 20 points of growth this past year,” Hughes said. “People are going back to the future, and that will have stickiness; our better-for-you brands in three months got 18 months-worth of trial,” he said.

“For many big-box retailers right now, it’s about in-stock, not innovation,” Hughes quipped. “We’re seeing cutbacks so they can spread out on the essentials. That will be a headwind for emerging brands in 2021,” he observed.

“With that said, the real game changer for the future is what’s happening with direct to consumer (D2C) sales. D2C gives the consumer the option to buy not just what they want, but also what they may have never heard about. It’s going to be triple or quadruple what the growth was last year,” Hughes predicted.

“It’s going to be harder for a brand to break into natural products retail the old-fashioned way in the next 12-18 months. However, the next generation of brands is more likely to happen online, and when they get to be $10-20 million online businesses, then they can go to Whole Foods Market or other grocers and say we have so many people buying in your respective markets. It’s a whole new innovation model,” Hughes said. “Brick and mortar used to be the channel that led. Now, people will order online, and brick and mortar will follow.”

People Remember How They Were Treated – Gabe Nabors, CEO, Mustard Seed Market

“People are going to remember how they were treated in these times,” said Gabe Nabors, CEO of the two-store independent, family-owned natural products retailer Mustard Seed Market in Akron, OH. “It could be the simplest thing of talking with someone or thanking people. At the end of the day, it’s about being transparent with your staff and customers.”

Mustard Seed has had to continually pivot to serve its community while responding to the pandemic and safety and public health demands. Known for outstanding foodservice offerings, the retailer temporarily closed its restaurant when the county heightened safety restrictions, and converted the salad bar to a grab and go bakery set in its downtown location when nearby offices closed and lunch business dropped off.

The independent retailer also has had to contend with a lack of consistent product availability, Nabors shared. “We were getting an insane amount of out of stocks, so we reset aisles based on what’s selling well and what’s available. Out of stock items are still a problem, but we’ve mitigated it by changing up the sets and finding comparable products – and by communicating constantly with our partners. I would say communications with manufacturers and distributors are at an all-time high right now. And what worked last month doesn’t mean it will work next month – you have to monitor your own in-store trends faster than you ever had to before,” Nabors said.

Not one to stand still, Mustard Seed recently launched MustardSeedWellness.com to expand its ecommerce presence, plus plans are in the works to remodel its flagship store. “The focus will be on fresh new floors, redesigned prepared foods areas to allow for more grab and go, and an expanded meat department. We’re investing in some store improvements in 2021,” Nabors added.

Building Resilience on the Shelves – John Raiche, EVP, Supplier Services, UNFI

“Coming out of Thanksgiving week, consumers saw the grocery shelves were much more resilient than earlier in the year when the pandemic hit,” noted John Raiche, Executive Vice President of Supplier Services at leading natural products distributor UNFI.

“Consumers have maintained pantry loads since the early days, so that may be a reason why the effect is more subdued. However, when consumers see a fully stocked shelf, they feel better than if they see empty shelf space, which may prompt them to panic buy. Going into 2021, we are seeing suppliers doing a much better job of meeting elevated in-home consumer demand,” Raiche observed. “Beyond that, the critical questions for our retailers will be what happens when in-home demand returns to more normal levels.”

Raiche, who shared he is responsible at UNFI for “looking at all the what ifs,” noted that everyone – suppliers, distributors and retailers – is working at elevated levels, allowing much less room for day-to-day hiccoughs, such as weather and delays. He shared his concern that worker health could impact supplier production. “Manufacturers are doing everything they can, but if community spread of Covid-19 is widespread, they can’t control what happens outside their walls,” he said.

To better prepare, UNFI has altered its targeted safety stocks, bolstered inventory and is in close communication with its suppliers, Raiche said. “We stand ready at a moment’s notice to pivot and give suppliers the ability to deliver product. We host cross-functional team meetings focused on service level and how can we solve today’s challenge. Also, we are personally giving presentations to our retail customers to share what we’re seeing and projecting in the next week, month, six months, etc., so our customers understand what we’re seeing in the moment.”

Raiche predicts that demand will steady and service levels will continue to improve. “This week and last week have been the best service levels from suppliers we’ve seen since March – that’s a good sign. The good news for our country is that the vaccines are rolling out, but we don’t see it as a light switch. There is going to be a lengthy transition, and the increased level of in-home demand will last well into 2021,” Raiche predicted. “In the long run, if more consumers get comfortable with cooking from home, that’s great for our industry.”

Changing Food Consciousness – Tracy Miedema, VP of Innovation and Brand Development, Presence Marketing

“Even though we’re still in the midst of the pandemic, we know now that healthy food is critical to our health and wellness going forward,” said Tracy Miedema, VP of Innovation and Brand Development at leading independent natural products brokerage Presence Marketing.

Speaking of the huge spikes in absolute dollar growth of such mature categories as produce, baked goods, meat and dairy (plant-based meat and dairy alternatives, too, enjoyed unprecedented growth in 2020), “It’s hard to overstate how massive these changes are – the taxing and pushing of the food system. But the system has been able to adjust, shift volume from other places and produce this much more. The feat involved to flex and adjust our grocery system at this scale to adapt to the pandemic should leave us all in a state of awe,” Miedema said.

“How people think about groceries has radically changed since the pre-pandemic days when 50% of our food dollars were spent away from home. People have plowed that money into grocery shopping, and it has changed their minds about what food is worth. To me, that’s more than a little bit of upside – it points the way toward a growing consciousness of food that is vital,” she said.

“In the past, food was dominated by a small number of conglomerates and we were forced to eat middling food with simple carbs and processed oils. However, there’s been a massive fragmentation in food types and brands that’s been part of a 20-year trajectory. That fragmentation has led to the creation of nutritionally dense foods with features and benefits tailored to the consumer. Some of these upstart brand are less resilient and are being severely challenged during the pandemic. They should take heart that long-term wellness trends are on their side.”

Miedema also said that smaller and emerging brands that can learn to navigate change – and that can adapt to become “digitally native brands” may find new ways to succeed. “If you’re a small brand, you’re hoping that the right person finds you on the shelf, but if you’re also online, that person is searching for you. It can flip the ‘foot traffic’ in your favor,” she advised.

View from a SuperNatural – Anonymous, from a Major Natural Retail Chain

“The tough thing about 2021 is that the first six to eight months are going to look very similar to 2020,” said a senior executive with a prominent natural products retail chain who asked not to be named. “The at-home trends are going to last, at least for that time, and the categories that went gangbusters are still doing well. Given that the next two to three months are going to be among the most challenging days of the pandemic, I don’t know if we’ll see the rush buying of the past, but retailers will see a solid January and February,” the individual said.

“However, the supply chain is still damaged, especially in paper and cleaning products,” the individual noted. Major cleaning products companies including Clorox, Seventh Generation and others have advised retailers and distributors that they may not see supply chain recovery until mid to late 2021. “The problem is compounded when a lot of these products are required for front-line healthcare needs,” the individual observed.

Also, of concern is an aluminum can shortage that will be an issue throughout 2021, the senior manager noted. “The reason being that for the last five years, the soda business has been declining and all the domestic can producers moved their production offshore. Right now, these companies are building out new plants in the U.S. to fulfill increased demand, but they will not be on line until late 2021 or 2022,” the individual projected.

“All of grocery is in a better spot today because we’ve been dealing with these elevated levels for so long, but it’s still a fragile ecosystem. Grocery stores were not designed to accommodate people eating 90% of their meals at home,” the individual said. “We are definitely trying to figure out how we can change the look of the stores to cater to the categories that are doing so well, such as baked goods, frozen foods, ethnic foods, spices and more. We’ve been going through this long enough that there will be muscle memory as we evolve. While we may know in 2021 what’s coming, 2022, however, is wide open in terms of how we emerge in the new normal.”

Serving Changing Distribution Needs – Jeremy Adams, Director of Category Management, KeHE Distributors

“As a distributor our goal is to service retailers and suppliers. Even with unprecedented demand, we were able to stabilize service levels in the summer and fall. As our industry spiked in demand, we were able to develop partnerships with food service distributors. As our demand increased and theirs declined, those partnerships to help with transport were key in helping us meet demand,” said Jeremy Adams, Director of Category Management for KeHE Distributors.

“Also, as we got more into the quarantine phase we witnessed the emergence of the home chef and home baristas. With restaurants and travel shut down, the only indulgence was things people could prepare at home. As such, we saw a huge spike in high-end foods, international cuisine, spices, premium coffee and more,” Adams said.

With a heightened winter demand for soup and broth and other pantry basics, Adams noted that suppliers are doing everything they can to catch up with demand. “Some were able to ramp up, depending on how they source, if they manufacture themselves, or work with a co-packer,” he said. Also, while interest in home cooking has grown, “there is a need for quick and convenient meal solutions. From research we’ve seen, 40% of shoppers are interested in trying meal kits sold in stores. In the fresh aisle, in particular, there was a major shift from salad and olive bars to pre-packaged. The biggest trend is that people want contactless options,” Adams observed.

Adams also noted, with an increase in pet ownership in 2020, the pet products category has seen a lift in sales. “The jump in pet ownership will bolster demand in 2021 not just for pet food, but for all related products, such as supplements and toys,” he said.

“We were already seeing growth in healthy products; the pandemic just accelerated that. In some cases consumers may have been forced to try new products due to out of stocks, the good news is they’re becoming repeat customers. Like never before, shoppers are looking at brands in terms of their mission and vision – are they sustainable, woman or minority owned, do they give back, etc. That will continue in the future,” he said.

Compared to What? Analyzing the Data – Jerry Stroobosscher, Director of Data Services and Analytics, Presence Marketing

After the initial panic buying peaks in March and April, both conventional and natural grocery stores have seen sustained growth averaging 10-15%, “and we are continuing to see this growth in both channels weekly as we compare year-over-year growth,” said Jerry Stroobosscher, Director of Data Services and Analytics for leading independent natural and organic products brokerage Presence Marketing. “As we know, people are staying at home more, cooking at home more, and while it is conversely affecting the restaurants, realistically, we are going to see this continue through the winter,” he said.

As a data analyst, Stroobosscher and his SPINS cohort Michael Murphy are warning decision makers not to “freak out when we see negative growth numbers as we cycle against this past year’s numbers come March and April.” Given all the unprecedented growth in 2020, comparing year over year growth in 2021 may be negatively impacted in both channels as the markets stabilize, they cautioned. “Once we start matching against a year ago, we are going to see some challenging numbers. The published growth rates may be worrisome to some, but understand that the channels themselves have expanded over this time frame, and we envision this to continue for a long time,” Stroobosscher said.

“The pandemic has broadened the definition of better for you products and how consumers look at the natural space in terms of building health and immunity,” said Michael Murphy, SPINS Onsite Manager with Presence Marketing. “We’ve seen a progression of consumers moving toward supplements, herbs and homeopathy.”

Of note, while data indicates that dietary supplement sales have dipped since March in the natural retail channel, conventional grocers have expanded their sales of vitamins and supplements. “Natural retailers may need to reevaluate their approach to dietary supplement sales as conventional grocers become a stronger player,” they advised.

The Challenge at Retail – Pat Sheridan, Interim President and CEO, INFRA

“One of the core reasons independent retail associations like INFRA (Independent Natural Food Retailers Association) and NCG (National Cooperative Grocers) exist is consolidating buying power. Our combined buying power certainly has been a differentiator during the pandemic,” said Pat Sheridan, Interim President and CEO of INFRA.

With 280 independent retail members across the country, “supply chain disruption has been one of the largest issues for members,” Sheridan said. “Regionally, things are different every day. It eased in the summer, but has been picking up again this fall and winter,” he shared.

INFRA has helped its members find product and alternatives to replace what’s missing. “We’re rounding out the year successfully, but there are still a lot of challenges. There’s light at the end of the tunnel, but realism and science say we have a ways to go, which means we’ll continue to see disruptions in the supply chain,” said Sheridan.

Sheridan shared that INFRA has a national supply agreement with KeHE Distributors for center store categories, “and we have other supplementary national agreements specifically in wellness, and we also have some regional relationships in place that allow us to negotiate and manage supply chain on behalf of a larger group. Most of our members would have little leverage otherwise,” he noted.

INFRA also focused on increased communications with members, including education, webinars and updates. “Our communications allowed us to hear which regions the pandemic was hitting early on to help our members better prepare.” In addition, the consumer’s focus on wellness presents an opportunity for independent retailers.

“Before the pandemic, we identified a number of stores that were at risk, and now they are still in business. My hope is that the pandemic provided a lifeline to these retailers where they have been able to adjust and grow and hopefully have a longer life span. Our job as a cooperative of independents is to provide the relationships and tools for our members not just to survive, but to thrive,” Sheridan said.

Meeting Demand, Keeping Workers Safe – Robert Agnew, SVP, Sales, Bob’s Red Mill

At Bob’s Red Mill, one of the nation’s leading providers of natural and organic pantry staples from baking flours to hot cereals, since the pandemic began, the company has been balancing 25-30% sales growth with worker safety and morale, said Senior VP of Sales Robert Agnew. “By February, we will have added six new production lines. While we are at an 80% fill rate, we plan to be back up in the 90-95% fill rate range by then,” he said. “Fortunately, we had been planning to get ahead of capacity; however, the demand was so great that it has been a challenge to keep up,” he said.

Regarding worker safety, “We take it very seriously and do everything we can to keep our workers safe. It does affect your efficiency; everything slows down with social distancing,” he said. However, Agnew pointed out that the entire factory has been retooled over the last six years and the company is designing its production lines to be more efficient. “With 400 SKUs, we paused some items to be more efficient, including slow movers and duplications in size,” he shared.

Anticipating that the in-home cooking trend will continue, “We are very transparent with our customers and distributor partners,” Agnew noted. “Our company is able to get through this because of the relationships we’ve built over the years. That comes from founder Bob Moore all the way through the organization. I manage the sales team and it’s important to keep morale high and be in close communications with my team and the entire company, reminding them that everything does pass and we’ll get through this together. It sounds trite, but it’s true,” he said.

Agnew also looks forward to a return to trade shows in the future. “I’m looking forward to sore feet and knees, and interacting with my customers, colleagues and industry friends again.”

Our People Are Heroes – Blair Kellison, CEO, Traditional Medicinals

Looking back at 2020, Blair Kellison, CEO of wellness tea brand Traditional Medicinals, referred to a quote in a holiday card he received from KeHE CEO Brandon Barnholt: “2020 was the year we learned our business is essential and our people are heroes.” “That quote summarizes the year for me,” Kellison said.

“If you’re a manufacturer, you were on the front line. Manufacturing businesses had to come to work every day – many of us could not work from home, we took no time off, and sales were skyrocketing. Whether it’s an economic downturn or the pandemic, when these things happen, people gravitate toward health and wellness products. When push comes to shove, people care about their health and are willing to spend money on it. That has supported our industry all these years, and when times are tough, it drives it faster,” Kellison said.

Kellison admits top brands are getting disproportionate attention from retailers right now. “Fill rates are important; retailers don’t have time and they seek reliability.” However, he also noted that for many companies, including Traditional Medicinals, it’s getting harder to introduce new products as retailers focus on best sellers and category leaders during the pandemic. “The hallmark of our industry is small companies, and yet it’s a hard time to launch innovation.” What Traditional Medicinals is doing is investing in IT and improving infrastructure. “You can’t get complacent; things will change back and you have to be ready,” he advised.

While Kellison anticipates that companies should prepare for more remote working in the future, he and Traditional Medicinals founder Drake Sadler have spent much more time connected and in the factory. “As the CEO, I began to work at the plant again, like the old days. Also, Drake and I were communicating much more, and being at the plant helped reinforce the connection with the front line workers,” he noted.

Kellison also predicted, “In-person appointments aren’t going away. They may be less often, but they’ll be more meaningful. As CEO, I would go on a lot of sales calls. I’ve flown, sat in lobbies for a 30-minute meeting. Now, with the digital tools at hand, I’m going on more sales calls than ever.”

Financing Soil Health – Robyn O’Brien, Co-founder, RePlant Capital

“Covid exposed vulnerability in the system and it is forcing us to build a better one. That starts with capital and how you deploy it,” said Robyn O’Brien, author of The Unhealthy Truth and Co-founder of RePlant Capital. Launched with co-founders David Haynes and Don Shaffer, the $250 million fund is focused on providing loans direct to farmers and incentivizing adoption of regenerative agricultural practices that rebuild healthy soils and help mitigate climate change.

“Initially, we thought we’d create a fund to invest in projects from soil to shelf, but the more we understood the crisis in agriculture, not only can we provide financing for farmers transitioning to organic and regenerative methods, we can have a positive impact on financial, climate and human health. If, for example, a farmer transitions 7,000 acres in Indiana from chemical agriculture to regenerative, that farmer can save up to half a million dollars a year. Currently, we are working on an almond project in California’s Central Valley that will generate significant water savings. We need to do this at scale and with alacrity,” O’Brien said.

O’Brien pointed out that while 80% of consumers are trying organic products, only 1% of U.S. farmland is organic. “It became clear there’s a bottleneck in the supply chain, leading to manufacturers importing organic grains from such countries as Romania and Bulgaria. The majority of our farmland is chemically grown; the organic supply chain in America barely exists,” she said.

O’Brien shared that the lead investors in the RePlant fund are women – “From the food industry and the tech industry, most are mothers; also, some early investors, both male and female, are CEOs from the food industry. In addition, according to O’Brien’s research, “Five times more women than men are moving into regenerative farming. Also, parents are realizing that if they want their kids to come back to the farm, regenerative, organic agriculture and financial resiliency are ways to attract them. There hasn’t been a financial services firm focused on climate solutions through soil health. We want to focus on progress, not perfection, and meet the farmers where they are,” she said.

# # #

Pandemic Shifts: Whole Foods Market’s Top 10 Food Trends for 2021

Photo: Wikimedia Commons

This article originally appeared in Presence Marketing’s November 2020 Newsletter

By Steven Hoffman

Citing the Covid-19 pandemic, “There have been radical shifts in consumer habits in 2020,” said Sonya Gafsi Oblisk, Chief Marketing Officer of Whole Foods Market, in an October 19, 2020, release announcing the world’s largest natural and organic products retailer’s Top 10 Food Trends forecast for 2021. “For example, shoppers have found new passions for cooking, they’ve purchased more items related to health and wellness, and more are eating breakfast at home every day compared to pre-COVID,” she said.

Entitled The Next Big Things: Top 10 Food Trends for 2021, the annual report highlights the predictions of Whole Foods Market’s Trends Council, comprised of more than 50 team members, including local foragers, regional and global buyers, and culinary experts who “compile trend predictions based on decades of experience and expertise in product sourcing, studying consumer preferences and being on the frontlines with emerging and existing brands,” the company said.

Significantly influenced by the current state of the food industry, Whole Foods’ 2021 trends report reveals some of the early ways the food industry is adapting and innovating in response to COVID-19 for a post-pandemic food world, the company said.

Whole Foods Market’s Top 10 Food Trend Predictions for 2021*

Well-Being is Served – The lines are blurring between the supplement and grocery aisles, and that trend will accelerate in 2021. That means superfoods, probiotics, broths and sauerkrauts. Suppliers are incorporating functional ingredients like vitamin C, mushrooms and adaptogens to foster a calm headspace and support the immune system. For obvious reasons, people want this pronto.

Epic Breakfast Every Day – With more people working from home, the most important meal is getting the attention it deserves, not just on weekends, but every day. There’s a whole new lineup of innovative products tailored to people paying more attention to what they eat in the morning. Think pancakes on weekdays, sous vide egg bites and even “eggs” made from mung beans.

Basics on Fire – With more time in the kitchen, home chefs are looking for hot, new takes on pantry staples. Pasta, sauces, spices — the basics will never be boring again. Get ready for reimagined classics like hearts of palm pasta, applewood-smoked salt and “meaty” vegan soup.

Coffee Beyond the Mug – The love affair between humans and coffee burns way beyond a brewed pot of joe. That’s right, java is giving a jolt to all kinds of food. You can now get your coffee fix in the form of coffee-flavored bars and granolas, smoothie boosters and booze, even coffee yogurt for those looking to crank up that breakfast parfait.