Executive Sweet: Lily's Sweets Founder Cynthia Tice and Former CEO Jane Miller on the Next Compass Coffee Talk

Executive Sweet: Lily's Sweets Founder Cynthia Tice and Former CEO Jane Miller on the Next Compass Coffee Talk

Cynthia Tice (Left), Founder, and Jane Miller (Right), Former CEO, Lily's Sweets

Join natural and organic leaders Cynthia Tice, Lily’s Sweets founder, and Jane Miller, former CEO, will join Compass Coffee TalkTM for a wide-ranging conversation about their collective experience leading and shaping influential companies. Fresh from the recent acquisition of Boulder, Colorado-based Lily's for a reported $425 million by The Hershey Company, Tice and Miller will share perspectives on their impressive track records of success, the state of the industry, their vision for 2022 and next steps.

About Cynthia Tice

After 40 years in the natural products industry, Cynthia Tice is focused on supporting women in business, finding and introducing the highest quality delicious products for healthier living, supporting young entrepreneurs, and sustainability. Her career in the industry began when, fresh out of college, she opened a natural food store in Philadelphia, and she remains passionate about natural foods and their benefits to people and the planet. In 2012, Tice founded Lily’s, a line of delicious, no-sugar-added line of treats that has disrupted the confection and baking categories. Following the initial launch of four bars, Tice added Lily’s No Sugar Added Baking Chips in 2014, and they became the number one item in natural-channel baking. She later partnered with private equity firm VMG to capitalize on Lily’s growth.

About Jane Miller

Jane Miller has more than 35 years of executive experience in the food industry with both startups and Fortune 500 companies. Most recently the CEO of Lily’s, Miller’s previous CEO positions include Rudi’s Bakery, ProYo High Protein Ice Cream, and HannahMax Cookie Chips. Her career began at PepsiCo, where she became President of Frito-Lay's Central division. Miller co-founded Haevn, a company dedicated to creating jobs for the next generation of leaders, and founded career advice website Jane Knows. She is the author of Sleep Your Way to the Top and Other Myths about Business Success (FG Press, 2014). Miller serves on the boards of the University of Colorado Leeds Business School, Watson Institute and Eldorado Springs Artesian Water. She earned her MBA from Southern Methodist University and a degree in Russian Studies from Knox College in Galesburg, Illinois.

About Compass Coffee Talk™

Take a 30-minute virtual coffee break with Compass Coffee Talk™. Hosted by natural industry veterans Bill Capsalis and Steve Hoffman, Coffee Talk features lively interactive conversations with industry leaders and experts designed to help guide entrepreneurs and businesses of any size succeed in the market for natural, organic, regenerative, hemp-derived and other eco-friendly products.

Compass Coffee Talk™ is produced by Compass Natural Marketing, a leading PR, branding and business development agency serving the natural and organic products industry. Learn more.

VIEW OUR PAST COMPASS COFFEE TALK EPISODES ON YOUTUBE

The Growth of the Independents – Join Pat Sheridan, INFRA, on Compass Coffee Talk, October 13, 11:30am EDT

The Growth of the Independents: INFRA CEO Pat Sheridan on the Next Compass Coffee Talk

Pat Sheridan, President & CEO of Independent Natural Food Retailers Association (INFRA), to Share Key Insights Into the Role of Retailers in a Changing Market on the Next Compass Coffee Talk, Wednesday, October 13

Wednesday, October 13, 11:30 am – Noon EDT

Zoom, Admission is Free

Natural products retailers continue to see growth despite an unpredictable economic climate and a supply chain in flux, with independent retailers and small chains leading the pack with 6.5% growth in 2020, according to New Hope Network's 2021 Market Overview. On Wednesday, October 13, natural and organic retailing leader Pat Sheridan will join Compass Coffee TalkTM for a lively deep-dive conversation into this current and future retail landscape for naturals. Sheridan will offer unique insights into the opportunities and challenges for retailers and for organic products as we move into a yet-to-be-defined new normal.

Independent Natural Food Retailer Association (INFRA) is a purchasing and business services cooperative of independently owned natural food grocers. INFRA currently represents retailers operating over 400 stores in 45 states with combined annual sales of over $2 billion. With a mission of strengthening its members through collaboration to forge a sustainable future, INFRA focused on key transitions throughout 2020 under Sheridan's leadership. In addition, as Secretary of the Organic Trade Association's Retailer Council, Sheridan participates in the trade association's forum focusing on organic-specific retail issues.

About Pat Sheridan

Pat Sheridan is the President and CEO of Independent Natural Food Retailers Association (INFRA), a purchasing and business services cooperative of independently owned natural food grocers. INFRA currently represents 300 members and 17 associate retailers operating over 400 stores in 45 states with combined annual sales of over $2 billion. Pat joined INFRA in 2018 as its COO & CFO and led its transformation to better serve members by leveraging technology solutions to deliver promotional and consulting opportunities. Pat also serves as Secretary of the Organic Trade Association’s Retailer Council. Prior to joining INFRA, Pat held executive positions in diverse industries such as healthcare, organic milling, and product development.

About Compass Coffee Talk™

Take a 30-minute virtual coffee break with Compass Coffee Talk™. Hosted by natural industry veterans Bill Capsalis and Steve Hoffman, Coffee Talk features lively interactive conversations with industry leaders and experts designed to help guide entrepreneurs and businesses of any size succeed in the market for natural, organic, regenerative, hemp-derived and other eco-friendly products.

Compass Coffee Talk™ is produced by Compass Natural Marketing, a leading PR, branding and business development agency serving the natural and organic products industry. Learn more.

VIEW OUR PAST COMPASS COFFEE TALK EPISODES ON YOUTUBE

Amazon’s to Open Whole Foods Market Stores Featuring Cashierless Technology

Photo: Wikimedia Commons

This article originally appeared in Presence Marketing’s October 2021 Industry Newsletter

By Steve Hoffman

Whole Foods Market announced on Sept. 8, 2021 that it will open two stores featuring Amazon’s “Just Walk Out” cashierless technology as an option for customers. The stores, expected to open in 2022, will be located in Washington, D.C.’s Glover Park neighborhood and in Sherman Oaks, CA.

According to Whole Foods Market, by using Just Walk Out technology, customers can enter, shop for the items they want, and simply exit the store. Those shopping using Just Walk Out will also have the option to use Amazon One, a fast, convenient, contactless way for people to enter, identify, and pay. If customers prefer, they can also opt to shop using self-checkout lanes or check out at the customer service booth with Whole Foods Market Team Members, the company said.

In a news announcement posted on Amazon’s website, Dilip Kumar, Amazon's VP of Physical Retail and Technology, said the company has engineered its Just Walk Out system, which relies on computer vision, sensor fusion and deep learning, to Whole Foods’ services and assortment. “Customers at these stores will be able to shop stations with self-service fresh-squeezed orange juice and mochi ice cream, while still shopping with the Just Walk Out experience and without adjusting any shopping habits,” he wrote.

“By collaborating with Amazon to introduce Just Walk Out Shopping at these two Whole Foods Market stores, our customers will be able to shop for fresh, thoughtfully sourced products that all meet our unparalleled quality standards, receive exceptional service from our Team Members throughout their shopping trip, and save time by skipping the checkout line,” said John Mackey, Co-founder and CEO of Whole Foods Market.

Though the new cashierless system offers the prospect of labor savings, Kumar noted that the stores using the Just Walk Out system “will employ a comparable number of Team Members as existing Whole Foods Market stores of similar sizes. With Just Walk Out-enabled Whole Foods Market stores, how Team Members in the store spend their time is simply shifting, allowing them to spend even more time interacting with customers and delivering a great shopping experience,” he said.

Organic Packaged Foods Contain Fewer Ingredients Linked to Negative Health Effects

Photo: Pexels

This article originally appeared in Presence Marketing’s October 2021 Industry Newsletter

By Steve Hoffman

Processed, packaged foods labeled as organic have a more healthful profile than their conventional counterparts, says a new analysis of 80,000 food products conducted by the Environmental Working Group (EWG) and published in the journal Nutrients.

The study focused on packaged foods, which EWG said accounts for more than 60% of the calories consumed in the U.S. The study analyzed nutrition and ingredient information for 8,240 organic and 72,205 conventional foods sold in the U.S. in 2019 and 2020. It is the most comprehensive study to date of the differences between non-organic, or conventional, packaged foods and those labeled as Certified Organic, said EWG.

According to the EWG study, organic packaged foods have fewer ultra-processed ingredients and additives that may promote overeating. EWG reported that the overall nutritional profile of organic foods is better, too, with less added sugar, saturated fat and sodium. Organic packaged foods contain more potassium, a heart-healthy nutrient found in fruits, vegetables and other unprocessed or minimally processed foods, EWG reported.

Nearly three-quarters of the U.S. packaged food and beverage supply in 2018 was ultra-processed, claimed EWG. This category of food makes up a significant source of calories for people over the age of two, and even higher for kids ages two to 19, EWG noted.

Nestlé, World’s Largest Food Company, to Invest $1.3 Billion in Regenerative Agriculture

Photo: Pexels

This article originally appeared in Presence Marketing’s October 2021 Industry Newsletter

By Steve Hoffman

With agriculture accounting for nearly two-thirds of Nestlé’s total greenhouse gas emissions – with dairy and livestock accounting for half of that – the world’s largest food company announced on Sept. 16, 2021, that it is investing $1.3 billion over the next five years to help its farmers and suppliers transition to regenerative agriculture practices.

“With our long-standing partnerships with farming communities globally, we want to increase our support for farming practices that are good for the environment and good for people,” said Mark Schneider, CEO of the Swiss-based food company in a statement. “In the spirit of enabling a just transition it is vital that we support farmers around the world that take on the risks and costs associated with the move towards regenerative agriculture.”

Nestlé’s Chairman, Paul Bulcke, added, "We know that regenerative agriculture plays a critical role in improving soil health, restoring water cycles and increasing biodiversity for the long term. These outcomes form the foundation of sustainable food production and, crucially, also contribute to achieving our ambitious climate targets."

According to Food Business News, Nestlé said it will focus primarily on three initiatives. First, Nestlé said it will use its network of R&D personnel and agronomists to develop more environmentally friendly crops and production practices. Second, the company said it will offer training and help producers exchange information and best practices that may be adapted locally, and that it will support farmers by co-investing with them, facilitating lending or helping obtain loans for equipment. Third, Nestlé said it is committed to paying premium prices for products produced using regenerative agriculture practices.

“This means rewarding farmers not only for the quantity and quality of ingredients, but also for the benefits they provide to the environment through soil protection, water management and carbon sequestration,” the company said.

Nestlé’s announcement was made in the lead up to the UN Food Systems Summit in New York, as part of Nestle's contribution to help achieve the Sustainable Development Goals (SDGs) by 2030, the company said. It also follows the recent report from the United Nations' Intergovernmental Panel on Climate Change that shows the climate crisis is intensifying, it added.

Sugar Free Is Top Sales Trend in Chocolate

Photo: Pexels

This article originally appeared in Presence Marketing’s October 2021 Industry Newsletter

By Steve Hoffman

“People are really thinking about self-care,” Joanna Lepore, Global Foresight Lead at Mars Wrigley, told the Food Institute. In that pursuit, consumers are seeking moments of indulgence from candy and chocolate, but they are increasingly opting for healthier alternatives. According to IRI data analyzed by the Food Institute, in the 52-week period ending August 8, 2021, chocolate candy dollar sales in the U.S. were up 5.8%, reaching nearly $12.8 billion. However, sales of sugar-free chocolate fared especially well over that 12-month span, increasing 27.4% to roughly $225.64 million. Lepore told the Food Institute that Mars Wrigley is aiming to create snacks to help consumers interested in portion control and consuming a “responsible level of calories and sugar.” She added, “We’re thinking about chocolate as to what role it plays in activating brand values, or giving back to sort of bigger planetary causes, but also thinking about it as being primarily this emotional, social connector.”

In related news, Hershey’s – one of America’s biggest names in chocolate – is responding to the plant-based trend by launching “Oat Made” vegan chocolate bars in select retail markets. “We're working with partners to keep a limited number of stores supplied with a limited quantity of inventory… We'll use the results of our in-market testing to determine whether we take the products to a national launch in the future," said Dan Mohnshine, Hershey’s team lead of strategic growth platforms, in a statement. “After finding that the ingredient formulas of existing products could be improved upon, our masterful R&D team at Hershey developed formulas using oats that we believe deliver better on consumers' expectations than what is in the marketplace today,” he said. Hershey’s launched organic Reese’s Peanut Butter Cups earlier this year, and vegan, plant-based Reese’s could be on the horizon, Food & Wine reported.

Iconic natural products company Dr. Bronner’s, however, is already there when it comes to standing behind values, giving back to planetary causes – and innovating plant-based, vegan products. Known worldwide for its natural and organic soaps and for its support of natural health and environmental causes, the company has set its sights on changing the cocoa industry for the better by launching Magic All-One Chocolate, its new line of vegan, fair trade, regenerative organic chocolates. Produced in direct partnership with small-scale cacao farmers, Dr. Bronner’s is using a model it established in 2009 to create its certified organic and fair trade palm oil project, reported Honeysuckle Magazine. “Born from the company’s industry-leading socially and environmentally responsible supply chain and developed with the expertise of world-class Swiss chocolatiers and industry experts—this is a chocolate experience like no other—from the brand that is best known for making soap like no other. Dr. Bronner’s Magic All-One Chocolate is the ultimate expression of ethical business, activist compassion, and deep love for the planet,” the company said in a statement.

Nootropics: An Emerging Trend in Cognitive Nutrition and Brain Performance

Photo: Pexels

This article originally appeared in Presence Marketing’s October 2021 Industry Newsletter

By Steve Hoffman

From young students, tech professionals, writers and others looking to enhance brain performance, focus and productivity to aging individuals seeking to boost cognitive health, nootropics is emerging as a significant category in dietary supplements. While consumers may not be familiar with the term itself, they are increasingly turning to nootropic products to help with learning, concentration, remembering, recalling information, gaining new skills, alertness, focus and other activities that require cognitive and mental function, says leading natural products market research firm SPINS in its recent The State of Natural report.

Nootropics (sometimes referred to as “smart drugs”) is a catch-all term for products that are reported to enhance brain and cognitive performance, from food and nutritional ingredients to dietary supplement formulations and even some prescription drugs. Taking gingko biloba or even drinking a caffeinated beverage are examples of taking a nootropic to boost memory or enhance alertness and focus.

According to SPINS, sales of functional nootropic ingredients including bacopa, phosphatidyl serine and DMAE all grew over 100% over the 24 weeks ending June 13, 2021. Other nootropic nutritional ingredients seeing sales growth include GABA, L-Theanine, Acetyl L Carnitine, gingko biloba, DHA, medicinal mushrooms, and more.

“A lot of companies are turning to a blend of different nootropic ingredients for a synergistic effect on cognitive health,” noted Scott Dicker, Marketing Data Analyst for SPINS. SPINS also advises retailers that educating yourself and customers is essential. Shoppers may understand what cognitive health is, but educating them and helping them become aware of the wide variety of supplements, foods and beverages that support brain function and cognitive health will help determine their in-store experience, and purchasing decisions, said SPINS.

As of July 21, 2021, “mental complex” supplements experienced a 58% year-over-year growth rate on Amazon, according to ClearCut Analytics in a report in Whole Foods Magazine. Sales have been steadily increasing for these type of supplements since August 2019, and ClearCut Analytics noted that trends often emerge on Amazon before reaching Food/Drug/Mass (FDM). Formulations in capsules are leading sales of mental complex supplements – capsules hold a 71% market share on Amazon, ClearCut Analytics reports.

Today’s aging population is helping drive sales of nootropics by focusing increasingly on brain and mental health, said ClearCut Analytics. SPINS also noted the COVID-19 pandemic has increased overall consumer interest in products for cognitive health.

FMI Survey: 80% of Food Retailers Say Hiring Issues Are Hurting Business

Photo: Pexels

This article originally appeared in Presence Marketing’s October 2021 Industry Newsletter

By Steve Hoffman

Eighteen months into the COVID-19 pandemic, 80% of food retailers surveyed by the Food Marketing Institute (FMI) said difficulties attracting and retaining employees is having a negative impact on their businesses. In its report released Sept. 15, 2021, The Food Retailing Industry Speaks 2021, 42% of retailers surveyed also indicated that supply chain disruptions continue to hurt their businesses. These constraints are happening at the same time that consumer demand for groceries increased 50% in the last year, resulting in unprecedented 15.8% growth in same-store sales, said FMI.

FMI’s 2021 survey represents over 38,000 food retail stores. The survey also found that 95% of food retailers with e-commerce options experienced an increase in online sales in 2020 as a result of changes in consumer behaviors related to the pandemic.

“The pandemic transformed almost every aspect of the food retail industry – from the way consumers shop for groceries and consume their meals to how food is grown, produced and transported to supermarket shelves, to our ability to staff our stores and serve our communities,” said Leslie Sarasin, President and CEO of FMI. “Throughout the past year and a half, the food retail industry has been adapting to meet the shifting needs of the communities they serve. This year’s ‘Speaks’ report outlines the resilience and transformation of the food retail industry amid the COVID-19 pandemic and examines the proactive strategies and investments retailers have made to adapt to the changing food retail landscape.”

“Frontline workers have been lauded as heroes in the face of the pandemic, but recruitment and retention became growing challenges as turnover rose sharply. Retailers have pursued many strategies to resolve these challenges, including increased wages and benefits, flextime and training/skills development”, FMI outlined in a 10 Key Takeaways summary excerpted from the retail report.

Regarding supply chain challenges, FMI said, “Perhaps more than ever before, supply chain is front and center in food retail. Pandemic shortages have led retailers to reassess their supply chains and their engagement strategies with trading partners. Trucking and transportation capacity represents one of the biggest hot-button issues, with some two-thirds of responding retailers saying it is having a negative impact on their businesses.”

Is Organized Crime Responsible for Shrinking Retail Margins and Higher Prices?

Photo: Pexels

This article originally appeared in Presence Marketing’s October 2021 Industry Newsletter

By Steve Hoffman

The answer is yes, according to Kroger CEO Rodney McMullen. McMullen told investors in a quarterly results call on September 10 that its gross margins decreased by 0.6% – and that approximately 25% of that decline was due in part to loss of inventory, or what retailers refer to as shrink. “That's heavily driven by organized crime or at least it appears to be,” McMullen said of the shrink factor, according to the Cincinnati Business Courier. “And I know Congress and other groups are starting to spend more time on understanding what's driving that and what's behind it and what's the distribution channels for the stolen products, as well, and trying to manage that,” McMullen said.

As a result of rising levels of theft, higher supply chain costs and increasing food prices overall, McMullen shared that the grocery chain will raise food prices 2% to 3% this year.

Mark Matthews, VP of Research, Development and Industry Analysis for the National Retail Federation (NRF) told the Cincinnati Business Courier that the organized crime Kroger referred to is not necessarily something involving the “mafia,” but instead comprises organized gangs of people stealing from stores, delivery trucks, warehouses and elsewhere for cash, and it’s a growing trend, he said.

According to NRF’s most recent security survey, 69% of retailers responded that they has seen an increase in organized retail crime. Earlier this year, Home Depot reported that it is using technology to try to curb what it said has become a crime problem as the cost of lumber skyrocketed during the pandemic. Kroger said it is working with trade associations to try to fight the amount of product theft the company is currently seeing.

Tackling food fraud, estimated to cost the food industry as much as $40 billion a year in lost sales, product recalls and legal bills, especially during the pandemic, has been challenging because of complex supply chains and the fact that products can change hands numerous times before they reach supermarket shelves, reported Bloomberg. Cases tagged as fraud, adulteration or authenticity-based jumped 38% in the fourth quarter of 2020, compared to the previous year, reported U.K.-based Food Forensics.

The pandemic has complicated efforts to crack down on such criminal activity, as police resources have been diverted and online marketplaces and delivery platforms are creating more opportunities for illegal goods to be sold, Kimberly Carey Coffin, Global Technical Director at Lloyd’s Register, shared with Bloomberg.

“We are as busy as we have ever been, particularly with white flaky fish, tomatoes, rice and other core commodities that are usually vulnerable to fraud,” Rick Sanderson, Business Development Director of Food Forensics, told Bloomberg.

In examples of the growing problem, the Associated Press (AP) reported in mid-September that four people were arrested on suspicion of stealing nearly $2 million worth of retail products from 43 different stores across California. Investigators found the merchandise the theft ring had stolen stacked “floor to ceiling” inside a mobile home and multiple storage units. In April 2021, police arrested two men and recovered nearly $1 million in goods stolen from grocery stores, AP reported.

Market Overview: Pandemic Boosts Natural Products Sales 12.6% in 2020

Photo: Natural Foods Merchandiser, New Hope Network

This article originally appeared in Presence Marketing’s October 2021 Industry Newsletter

By Steve Hoffman

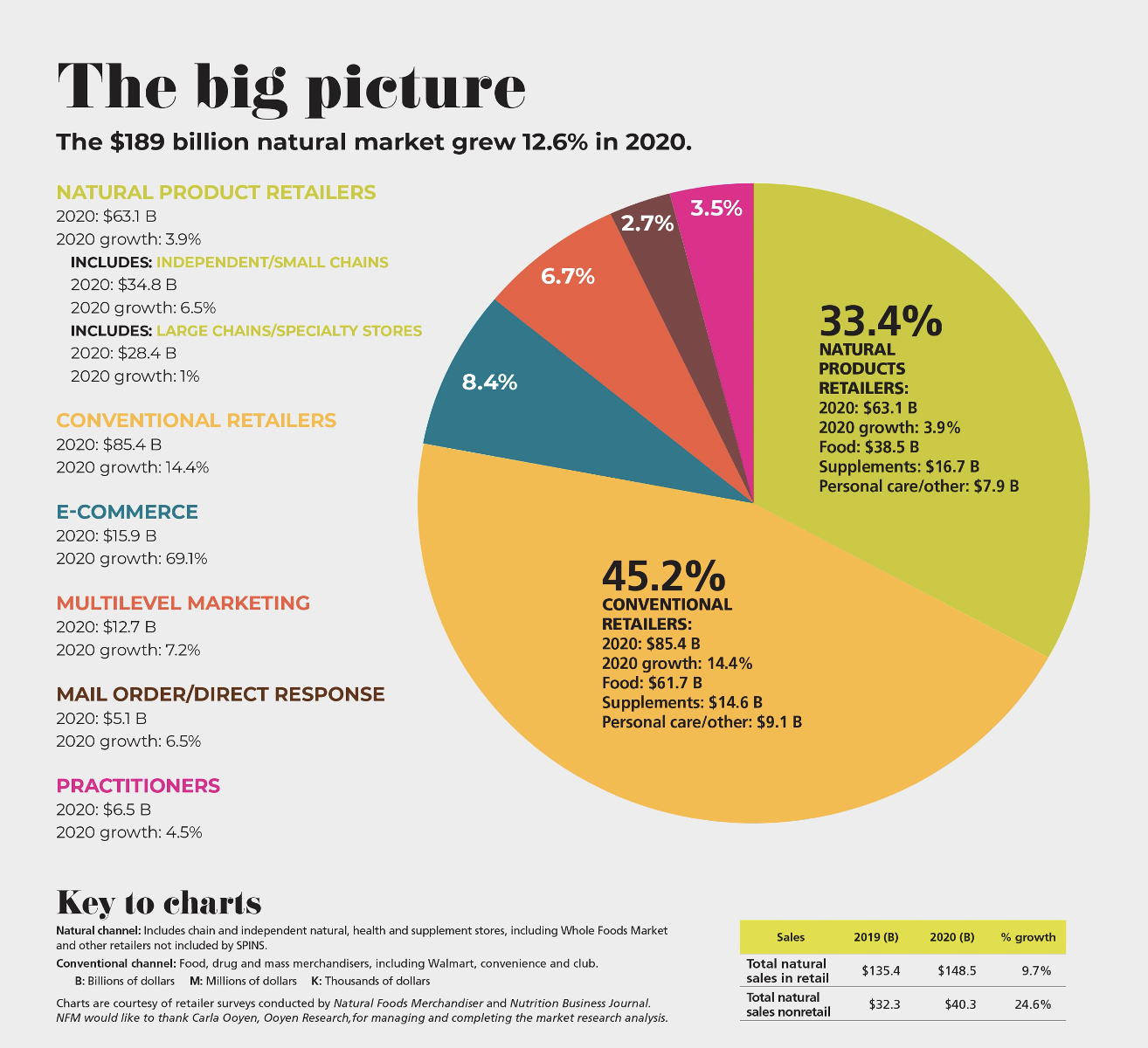

Many of the changes independent natural foods retailers adopted during the pandemic, such as digital ordering, curbside pickup, click-and-collect capabilities, traffic flow changes and more, may better help them compete going forward, writes Mark Hamstra in New Hope Network’s 2021 Market Overview Survey. And while natural foods retailers, like retailers everywhere, saw a decline in traffic, the uptick in basket size more than made up for it.

The average sales gain in 2020 among independent retailers surveyed was 6.5%, compared to 1% growth for large natural products chains. In particular, conventional retailers experienced 14.4% sales growth in 2020, and online retailers saw a whopping 69.1% sales growth in 2020. Of note, sales of natural products among health practitioners grew 4.5% in 2020.

Overall, the natural products market, estimated at $189 billion, grew 12.6% in 2020. Product categories leading the growth included meat, fish and poultry, condiments, dairy, fruit and vegetables, breads and grains, packaged/prepared foods and vitamins.