Organic Insider: An Interview with Max Goldberg on the Next Compass Coffee Talk, February 9, 11:30am EST

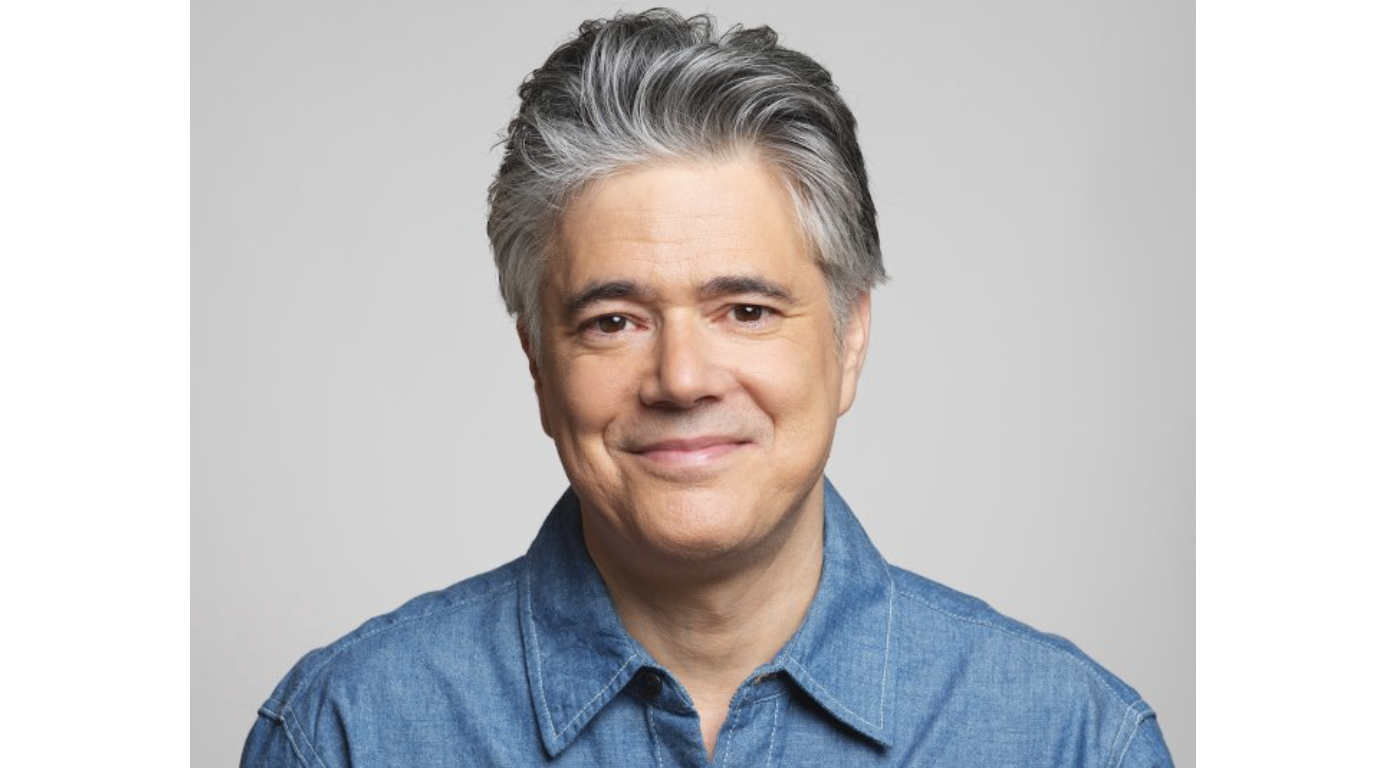

Max Goldberg, Founder and Editor, Organic Insider

Max will join podcast co-hosts Steven Hoffman and Bill Capsalis for a lively discussion on the opportunities and challenges facing businesses dedicated to organic food and agriculture; how consumer demand is driving innovation in the organic products market; and how organic products marketers can best navigate an uncertain market for success in the future.

Goldberg will share his perspectives on where the organic industry has come from; and how the global pandemic combined with heightened consumer demand for organic and unprecedented supply chain disruptions will shape the future of the organic industry. Importantly, Max will speak to how organic food & agriculture, by sequestering CO2 from the atmosphere back into healthy organic soils, can play a key role in helping to mitigate global climate change.

About Max Goldberg

Called “an organic sensation” by The New York Times and named as “one of the nation’s leading organic food experts” by Shape magazine, Max Goldberg is the Founder/Editor of Organic Insider, a newsletter read by many of the most influential CEOs in the industry today. He has been covering the organic industry for the past 11 years and also runs the Organic Food Industry group on LinkedIn, which counts more than 35,000 members from around the world. A former Wall Street banker, Max received his BA from Brown University and his MBA from the Columbia University Graduate School of Business.

About Compass Coffee Talk™

Take a 30-minute virtual coffee break with Compass Coffee Talk™. Hosted by natural industry veterans Bill Capsalis and Steve Hoffman, Coffee Talk features lively interactive conversations with industry leaders and experts designed to help guide entrepreneurs and businesses of any size succeed in the market for natural, organic, regenerative, hemp-derived and other eco-friendly products.

Compass Coffee Talk™ is produced by Compass Natural Marketing, a leading PR, branding and business development agency serving the natural and organic products industry. Learn more.

VIEW OUR PAST COMPASS COFFEE TALK EPISODES ON YOUTUBE

As Supply Chain Problems Persist, Grocery CEO Predicts Food Prices Will Surge 10% in Next 60 Days; Meanwhile, Conventional Food Prices Are Catching Up to Organic

Photo: Pexels

This article originally appeared in Presence Marketing’s November 2021 Industry Newsletter

By Steven Hoffman

As the backlog of shipping containers at U.S. ports continues, Americans could see shortages of products across the country that will persist into the holidays, analysts are cautioning. Adding to the backup at the ports are driver and labor shortages across all channels of distribution. As a result, shoppers are again facing empty shelves, with pet food, diapers, frozen dinners, spices, chicken and other items listed as being in short supply in the nation’s grocery stores.

In addition to product shortages, food prices could increase 10% in the next two months, predicted John Catsimatidis, president and owner of the supermarket chains Gristedes and D’Agostino Foods.

The billionaire grocer told Fox Business that leading food companies will begin to prioritize products and raise prices. “I see food prices going up tremendously,” he told Maria Bartiromo on Mornings with Maria. “[CEOs] want to be ahead of the curve and the way they’re doing it is they’re dropping all promotions. They are dropping their low-moving items.”

Projecting a 10% price increase in the coming weeks, Catsimatidis said the trend won’t be ending “anytime soon,” as companies make more profits. “Why give away something when you don’t have to give it away and you make more margin?” he asked rhetorically. “So, I think that now these companies are going to have record profits in the third quarter,” he told Bartiromo.

According to the New York Times, Thanksgiving 2021 “could be the most expensive meal in the history of the holiday…Nearly every component of the traditional American Thanksgiving dinner, from the disposable aluminum turkey roasting pan to the coffee and pie, will cost more this year, according to agricultural economists, farmers and grocery executives,” writes food reporter Kim Severson. “Major food companies like Nestlé and Procter & Gamble have already warned consumers to brace for more price increases,” she reported.

Organic Food Prices Holding the Line More than Conventional…for Now

Meanwhile, researchers at Magnify Money, a division of Lending Tree, reported that conventional food prices are rising at a “much faster rate than organic costs.” According to its research, since 2019, prices for select conventional meats, dairy items, fruits and vegetables have increased by an average of 13.9% – 12 percentage points higher than the reported 1.6% growth in costs for comparable organic items.

Despite rising conventional food prices, organic foods on average remain more expensive, the Magnify Money researchers pointed out. However, they said, “For those organic-preferring shoppers, the good news is the costs of organic produce, dairy and meats are rising slower than conventional foods.”

However, while organic prices may not be rising as fast as conventional products, the $56 billion organic food industry also is grappling with a shortage of shipping containers and a tight labor market. One organic commodity being affected by the backup at U.S. ports is organic soybeans, much of which is imported into the U.S. in shipping containers, reported Reuters. Costly organic soybeans and higher priced organic products are fueling food inflation “at a time consumers are eager to eat better and focus on health during the COVID-19 pandemic,” Reuters reported.

Bell & Evans – a 127 year old chicken producer based in Pennsylvania – feeds 500,000 to 600,000 organically raised chickens each week, and must compete for soybeans with other buyers that formerly relied on imports, owner Scott Sechler said. The company raised all chicken prices in July and will likely need to raise organic prices again, he told Reuters. "We're in the most challenging time since the organic world started when it comes to feeding animals and selling an organic animal protein. It's a madhouse now. There's not enough in America to replace all the imported organic grain," Sechler said.

U.S. sales of organic food jumped by 12.8% in 2020 to $56.5 billion, compared with a 4.6% increase in 2019, according to the Organic Trade Association. Organic accounted for 5.8% of food sales in 2020 as the pandemic motivated consumers to eat more meals at home and focus on products perceived to be healthful, OTA said.

Retailers, Consumers and Manufacturers Are Beginning to Hoard Products…Again

While food and consumer product shortages are not as acute as they were in the early days of the COVID-19 pandemic, industry analysts are reporting that shoppers are beginning to hoard products, again. That, combined with ongoing supply chain problems, and retailers and food producers alike are planning for shortages to last into the near future.

In an interview with Spectrum News’ Bay News9 in Clearwater, FL, natural foods retailer Nature’s Food Patch General Manager Sean Balsley said some products have been hard to find, so when items in demand for the holidays are available, he buys extra. “You got to take it when you can get it,” he said, noting that some popular items for Thanksgiving have been difficult to order.

Adnan Durrani, CEO and founder of Saffron Road, producer of a popular line of natural frozen and shelf-stable foods, told Bloomberg that the company is holding onto extra inventory, keeping four months of supply in stock instead of one or two months of inventory normally held in past years. “People are hoarding,” Durrani told Bloomberg. “What I think you’ll see over the next six months, all prices will go higher.”

Food Prices Increased 4.5% in September Alone, Compared to 2020

Prices for food consumed in the home increased 4.5% in the month of September 2021 alone, compared with prices in the same month in 2020, as input costs continue to rise and more companies pass these costs on to consumers, reported The Food Institute. The question, the Institute asked, is how far can major brands push shoppers on price before they choose cheaper alternatives, search for lower cost brands, or reduce the number of items they purchase.

According to data from the Consumer Price Index, Fox11 News in Los Angeles reported that food prices increased 4.6% in the year since September 2020. Meat prices rose 12.6%, seafood prices increased 10.7% and categories including fruit, vegetables, cereals, bakery items and non-alcoholic beverages all charted significant prices increases in the past year.

Labor shortages in the supply chain are greatly responsible for price hikes, claimed Nate Rose, Senior Director of Communications for the California Grocers Association, in an interview with Fox11 News. Rose noted that labor shortages lead to reduced supply and increased prices. “People are seeing some more significant upticks in their food costs, especially around meat, year over year…It’s a tough one because demand is strong and right now producers are struggling to meet the demand because of short labor,” he said. “There’s been a lot of coverage of the situation at the ports but it’s also the shortage of truck drivers and people at the distribution centers. It’s tough to see these prices climb continually and I know people are feeling that in their pocket books,” Rose said.

In an interview with ABC Eyewitness News, U.S. Transportation Secretary Pete Buttigieg acknowledged the shortage of truck drivers, exacerbated by the fact that many drivers are older and few young people want to enter the field. He said the Biden administration is taking steps to streamline the process by which prospective drivers can obtain commercial vehicle licenses.

"The more red tape we can cut out of the process of getting those (commercial driver licenses), the more we can get drivers on the road, and make it possible for them to add to our supply capacity," Buttigieg told ABC. "But I should also be blunt: truck driving needs to be a more well-compensated and more respected profession. Look at the turnover margins in trucking. In large companies it can be 90% turnover per year,” he said.

Inflation Approaching a “Tipping Point at the Grocery Store”

Heading into the holidays, product shortages and purchase limits from major food and consumer product manufacturers "will be a challenge in the grocery industry" in the final months of the year, Steve Howard, VP of Merchandising for Bristol Farms, a leading California-based specialty grocery chain, told CNN. Suppliers are warning the retail chain of "potential shortages" of food products, glass jars and packaging containers, he said.

CNN reported that approximately 18% of beverages, 15% of frozen foods, 16% of snacks, 15% of candy and 18% of bakery items were out of stock at stores during the week ending Oct. 3, 2021, according to data from market research firm IRI, which tracks in-stock levels at leading U.S. grocery chains, big box stores, pharmacies and wholesale clubs. Before the pandemic, IRI reported that 7% to 10% of products were typically out of stock on shelves, according to CNN.

In response to a tighter supply as the country heads into Thanksgiving, Howard told CNN that Bristol Farms is working to bring in inventory "earlier than any other holiday ever," he said.

Noting that inflation may be “approaching a tipping point at the grocery store,” the Wall Street Journal reported that, as a rule of thumb, price increases above 5% are difficult to implement without resulting in changing consumer buying patterns.

Jamie Court, president of Consumer Watchdog, shared people’s concerns about across-the-board price surges. In a Fox11 News interview, she said, “The price of everything we need is up. The gas, the food, and the reality is we don’t know if it’s going to be short term or long term.”

# # #

Steven Hoffman is Managing Director of Compass Natural, providing brand marketing, PR, social media, and strategic business development services to natural, organic, sustainable and hemp/CBD products businesses. Compass Natural serves in PR and programming for NoCo Hemp Expo and Southern Hemp Expo, and Hoffman serves as Editor of the weekly Let’s Talk Hemp Newsletter, published by We are for Better Alternatives. Contact steve@compassnaturalmarketing.com.

Natural Products Sales Outpace Conventional

Photo: SPINS

Originally Appeared in Presence Marketing News, October 2019

By Steven Hoffman

If you look at the state of the natural and organic products industry, says market research leader SPINS, one of the primary takeaways is this: “The 5% sales growth rate for natural food and beverages over the year ending May 19, 2019, was nearly three times greater than for the overall food and beverage industry—continuing a now-longstanding trend,” reported New Hope Network. “Natural products have been outpacing their conventional counterparts for some time in terms of dollar growth,” said Jessica Hochman, SPINS senior manager of natural insights and innovation research and the lead author of the State of the Natural Industry report in a webinar presenting results from the study. According to SPINS, natural and organic products sales totaled $47.2 billion over the 12-month period and accounted for 10.5% of the overall $448.2 billion food and beverage market. In addition, natural products sales accounted for 29.3% of all food and beverage industry sales growth, says SPINS. In the convenience store channel, while natural products accounted for only 4.6% of total C-store sales, growth of these products over the one-year period was 12.6%, due to rising consumer demand for convenience and natural snacking. The data, presented as part of the Good Food insights series in collaboration with FamilyFarmed’s Good Food Accelerator and Naturally Chicago, Esca Bona and SPINS, will be highlighted on October 7 at Naturally Chicago’s Quarterly Keynote Event in Chicago. Presence Marketing / Dynamic Presence is a Sponsoring supporter of Naturally Chicago.

Market Update: Organic and Plant-Based Food Sales

Originally Appeared in Presence Marketing News, August 2019

By Steven Hoffman

Rabobank: Organic Food Sales Growth Slows; Market to Hit $60 Billion by 2022

Between 2010 and 2016, organic food retail sales grew by an average of 10% per year, however, that growth has slowed to 5.9% for the past two years, says Rabobank. The international bank, known for its focus on food, predicts that organic food sales will reach $60 billion by 2022. While fruits and vegetables remain the top organic food category, representing 36% of all organic food purchases in 2018, even that category is showing signs of slowed growth, noted Rabobank Senior Analyst Roland Fumasi in a report by Food Navigator USA. “Organic produce availability has now become mainstream which means that the organic produce market will continue to more closely resemble the traditionally grown produce market,” Fumasi told Food Navigator USA. “Just a few short years ago, both organic produce prices and organic produce volumes were rising, indicating that demand expansion was occurring more rapidly than supply growth. However, there are indications that continued growth in the organic movement has partially been driven by lower prices for some of the top-selling organic product items.” Fumasi predicts that in a few years, demand for organic produce will see an increase in sales as millennials grow their income and start their own families.

Plant-based Food Sales Growing 5X Faster than Overall Food Sales

Plant-based food sales are growing like a weed, according to new research from the Plant Based Foods Association and the Good Food Institute. According to the research published in July 2019, U.S. retail sales of plant-based foods have grown 11% in the past year, bringing the total plant-based market value to $4.5 billion. Since April 2017, total plant-based food sales increased 31% according to the study. Additionally, plant-based foods unit sales are up 8.5%, compared to total U.S. food sales, which are flat, showing the overall health and momentum of the plant-based foods category. The data covers the total U.S. grocery marketplace and was commissioned from SPINS, a wellness-focused data technology company and retail analytics provider, says the Plant Based Foods Association (PBFA). According to PBFA, sales of the plant-based meat category alone is worth more than $800 million, with sales growth of 10% in the past year. Refrigerated plant-based meat is driving category growth with a 37% sales increase. Sales of plant-based milks, which grew 6% over the past year, now comprise 13% of the entire milk category, while cow’s milk sales have declined 3% over the same period. In addition, in the past year, plant-based yogurt has grown 39%, while conventional yogurt declined 3%; plant-based cheese has grown 19%, while conventional cheese is flat; and plant-based ice cream and frozen novelty has grown 27%, while conventional ice cream and frozen novelty has grown just 1%, according to the PBFA study.

Good Food Insights: Natural Continues to Set the Pace

Here’s some good news for natural products marketers, writes New Hope Network’s Bob Benenson: Natural product sales are growing five times faster than conventional product sales nationally—in the Multi-Outlet (MULO) channel, a.k.a. traditional grocery chains. Here’s the even better news: Natural product growth in this channel, where the vast majority of Americans get their groceries, outstrips conventional growth in all seven regions of the U.S., as defined by SPINS, the leading data market research firm for the natural, organic and specialty products industry. Along with FamilyFarmed’s Good Food Accelerator, Naturally Chicago and Esca Bona, SPINS is a collaborator in the Good Food Insights series. Based on the annual State of Good Food Report, derived from SPINS’ analysis of MULO market data for the 52 weeks ending May 19, 2019, while natural products comprise 9% of total sales in the MULO channel, sales in this category grew 5% over the study period, compared to 1% growth for conventional products. “Conventional retailers are recognizing that the rise of natural is an ongoing historic and generational shift, not a fad. And as they address consumer demand by adding more natural products to their shelves, they are jump-starting further growth in the sector,” writes Benenson. According to SPINS, California has the largest MULO market share of natural products at 14%, followed by the Northeast, with 12% MULO market share for natural products. The South-Central states recorded the lowest MULO market share, with only 6% of sales attributed to natural products. According to Andrew Henkel, SVP of Brand Growth Solutions at SPINS, the forerunner regions have the biggest consumer bases that are apt to adopt a “good food and natural products lifestyle.” “Parts of the country that have significant urban, progressive consumer bases are indicators of where the rest of the country is going to go,” Henkel told New Hope Network.