In Remembrance of Michael McGuffin, Herbal Industry Pioneer

By Steven Hoffman

Michael McGuffin, a renowned founder of the modern-day herbal products industry and for more than 25 years the President of the American Herbal Products Association (AHPA), passed away on Feb. 17, 2025, at the age of 73.

Michael was well known as a tireless advocate for consumer access to botanical medicine, industry self-regulation, and the safety and efficacy of herbal products. Under his leadership, AHPA spearheaded the request for mandatory reporting of serious adverse events; ensured a place for dietary supplements under the scope of the National Organic Program; provided support to the emerging CBD industry; and served as a key industry resource for regulatory guidance, policies and trade requirements.

Born in 1951 in Louisville, Kentucky, McGuffin was an early natural foods retailer – in 1974 he opened a store selling fresh fruit, vegetables and bulk herbs in Venice, California, and in 1978 he co-founded McZand Herbal Products (now known as Zand). After serving on the board of AHPA for nearly a decade, Michael took on the role of President in 1999. He retired from his leadership role at AHPA in November 2024. Michael also served on the boards of the American Herbal Pharmacopoeia and United Plant Savers, and as a member of the Advisory Board of the University of Southern California School of Pharmacy Regulatory Science Master's Degree Program. McGuffin was awarded the Cliff Adler “Heart in Business” award in 1994 and the Nutrition Business Journal Award for Efforts on Behalf of Industry in 2004 and 2012.

"All companies that sell herbs and botanical ingredients in the United States owe a debt of gratitude to Michael (and AHPA), and they should be supporting AHPA and Michael’s work and laudable legacy," Mark Blumenthal, Director of the American Botanical Council, wrote in a statement. "When the history of the herb industry in the United States is written — 50 or perhaps 100 years from now — Michael will be at the top of the list of people who have been instrumental in building the modern herb industry. The U.S. herb industry is flying its virtual green flag at half-staff in honor of Michael."

Steven Hoffman is Managing Director of Compass Natural, providing public relations, brand marketing, social media and strategic business development services to natural, organic, sustainable and hemp/CBD products businesses. Contact steve@compassnaturalmarketing.com.

The Life in Your Years — Healthspan Trend Revitalizes Natural Products Sales

This article first appeared in the February 2025 issue of Presence Marketing’s newsletter.

By Steven Hoffman

As the saying goes, “It’s not the years in your life that count, but the life in your years.” Today, that sentiment is emerging as a lasting market trend, driven by a growing awareness of the concept of “healthspan” vs. “lifespan.”

Over the past few years, consumers have been shifting their focus on health and aging away from just extending the years in one’s life to enhancing the quality of life and health across a lifetime. From the growth in sales of dietary supplements, functional foods and “blue zone” diet products to “bio-hacking,” self-diagnostics and other personalized healthcare tools, the idea of active aging, or healthspan, is taking root.

And it’s not just aging baby boomers seeking to close the gap between lifespan and healthspan in order to remain energetic, vibrant, healthy and free from debilitating illness into advanced age. Recent research indicates that consumers of all ages are interested in promoting longevity and optimal health

"As consumers become drawn to the idea of healthspan, many are leaning into the idea of lowering their biological age – this can span from maintaining cellular health to ensuring they have strong muscles that can help them age gracefully and prevent falls. Aging has mostly been talked about in the context of outward appearance but consumers are now looking inward and optimizing for better functionality and performance as they age,” said the authors of the SPINS 2025 Industry Update & Trends Predictions, published in December 2024. "Lifespan has switched to healthspan focused on personal health and longevity. Chronological age vs. biological age is a new metric — and consumers want to biohack their way into feeling younger,” they added.

Healthy Aging Supplements Exponentially Outpacing Industry Growth

Natural products retailers are well positioned to capitalize on the healthy aging trend. “From lifespan to healthspan, the quest for longer, more active lives is driven by cutting-edge research, technologies, and tools, including a heightened focus on nutritional health and supplements. This year, The Vitamin Shoppe installed longevity-centric product displays in all stores to spotlight key areas of healthy aging needs, including cognitive health, cellular health, and mobility support formulas. Cognitive support products are the biggest sales driver by volume in the new longevity merchandise set, while cellular health support saw the biggest sales gains in 2023, up over 45% from the previous year,” the company said in its Vitamin Shoppe Health & Wellness Trend Report 2024, released in June 2024.

According to Nutrition Business Journal’s (NBJ) 2024 Condition Specific Report, which tracks the supplement market by ingredient category, sales channel and condition, “Brain Health hit the top of the growth chart and is expected to remain No. 1 through 2027, which is as far as we forecast,” Bill Giebler, NBJ’s Content and Insights Director, wrote in September 2024. “What’s compelling, though, is that Healthy Aging, which held the No. 9 growth position in 2020 and 2021, is expected to climb to the No. 2 growth position next year. Supplement usage always fluctuates between correction, maintenance and optimization, with the former two being the bedrock of the industry. Increasingly, though, optimization is coming into play,” he noted.

Market researchers also found that more than half of consumers are taking supplements to extend their healthspan, “and they’re not all seniors,” according to NBJ’s Longevity Report, published in September 2024. According to the study, sales of supplements for healthy aging have been exponentially outpacing overall supplement industry growth since 2022, and are projected to exceed $1 billion in 2027.

"Younger generations are just as, if not more, likely to be more concerned about the quality rather than the quantity of their later years. Millennials, in particular, are watching their aging parents struggle with debilitating health and cognitive issues and realizing they don’t want to grow old that way. Already more proactive about their health than the generations preceding them, millennials are a ripe market with a lot of runway for products that could not only help them stave off wrinkles and male-pattern baldness but also heart disease and dementia,” wrote Longevity Report author Robyn Lawrence.

“And when it comes to maximizing both healthspan and longevity, millennials are going all in on the biggest buzz in healthy aging circles these days: biohacking, or biological self-experimentation with the aim of fine-tuning both physiology and the nervous system to function optimally. NBJ found that taking supplements is the top activity or habit biohackers incorporate into their regimens, opening up a massive opportunity for supplement brands, and over half of millennials — more than any other generation — were somewhat or very interested in biohacking. More than a third of millennials said they would be more likely to buy products that are labeled and marketed using the term biohacking. For supplement brands, all of this means it’s time to take a good look at millennials,” Lawrence advised.

Surveys conducted for the Longevity Report found that consumers put supplements third only to diet and exercise when ranking the actions they’re taking to increase longevity and improve their healthspan. Sixty percent of women and 44% of men say they take supplements to extend their healthspan, NBJ found.

Blue Zone Diet and Foods for Longevity

As consumers catch on to the health risks associated with ultra processed foods, many are turning to whole foods and minimally processed options for healthy aging. “Consumers want their food to work harder for them,” Kathryn Peters, head of industry relations at SPINS, told Fi Global Insights in September 2024. “Consumers are moving away from processed foods, and back towards whole foods. Nutrient density has become a big topic. Consumers might be looking at the relative nutritional benefits of beans vs. processed white bread. They are also interested in consuming more protein and trying to stay away from added sugar. Consumers are demanding more from their products, and manufacturers need to find ways of seeking out ingredients that are minimally processed and better for their health. This is a macro-trend we are seeing, particularly in U.S., but also globally. Consumers are trying to figure out what habits they need to develop to help ensure they have a long and healthy lifespan,” Peters said.

Peters noted the healthspan trend also encompasses the beauty and self-care sectors, with consumers wanting to look and feel young and vibrant at every life stage. Peters pointed out that when it comes to beauty care, consumers prioritize premium brands and are unwilling to cut corners. “This underlines the importance and potential of this macro-trend. This mindset of wellbeing, of looking and feeling young, is here to stay,” she said.

Having studied and written extensively about the world’s “blue zones,” where individuals commonly live to be centenarians, Dan Buettner, a National Geographic Fellow, New York Times best-selling author and Netflix host, co-founded Blue Zones Kitchen, a line of non-GMO, plant-based frozen meals. The line is now sold in more than 1,000 grocery stores, including Whole Foods Market, Wegmans and more. “Many health problems are related to eating processed foods, sugars and red meats, compounded within a healthcare system that expects doctors to talk to people in 15-minute appointments,” Buettner told attendees at Newtopia Now in August 2024. “Fortunately,” he said, “the foods that make up the diets of the world’s longest-lived people are the cheapest ingredients. They’re whole grains, beans and tubers [root vegetables].” According to Buettner, despite all his findings about the importance of exercise and social connections, the most direct healthy aging interventions for most Americans will happen in the kitchen. “I’d start with the food,” he advised.

Sharing insights about foods for longevity, Dr. Paul Savage, M.D., a specialist in toxin reduction and chronic inflammation, emphasized that a long and healthy life isn’t just about choosing the right foods — “It’s about choosing them wisely. Prioritize organic, wild-caught, and toxin-free options wherever possible to ensure you’re maximizing the health benefits and minimizing exposure to harmful substances,” he said.

The Ozempic® Effect and Healthy Aging

Glucagon-like peptide-1 (GLP-1) receptor agonists (GLP-1 RAs) — a drug that is currently very popular in the treatment of diabetes, obesity and weight loss — reportedly may help with healthy aging by improving insulin sensitivity, reducing inflammation, and promoting DNA repair. According to National Institutes of Health researchers in a study published in 2023, “GLP‐1 RAs provide proven and potential benefits that may help people experience a prolonged healthy lifespan with reduced risk of serious and chronic aging‐related conditions. Thus, the drug class is positioned as a novel pharmacotherapeutic option that in combination with non‐pharmaceutical interventions can help address the pronounced medical need associated with the aging human population.”

Natural products retailers are reporting a bump in sales of products related to the increased use of GLP-1 medications. Consumers using such medications are seeking nutritional supplement support to help enhance the GLP-1 drug’s mechanism of action, to promote optimal nutrition while on the medication, and to deal with symptoms related to the use of GLP-1, such as maintaining muscle mass during weight loss.

In a study published in June 2024 on The Vitamin Shoppe’s Top Five Health and Wellness Trends, the company reported, “Supplements including proteins, multivitamins, fiber, and probiotics are taking on new importance for patients who are taking semaglutide or tirzepatide weight-loss drugs, such as Ozempic® and Mounjaro®. A sales bump in certain supplement categories that support proper nutrition can already be seen at The Vitamin Shoppe. Ready-to-drink protein beverages, for example, were up 10% in 2023 versus the previous year, and meal replacement products tailored to weight management are up 13% in the first four months of this year. Industry-wide, protein supplements and meal replacements were up 15% for the 52 weeks ending November 5, according to SPINS data.”

“It's by far the hottest thing I've ever seen in my 20 years, and it's not a fad,” Robert Brewster, president of Ingredient by Nature, a company that markets a probiotic strain it refers to as a “longevity probiotic,” told Nutritional Outlook in November 2024. “GLP-1 is not going away.”

Healthspan: A Holistic Healthcare Approach

“While longevity is top of mind, it’s not the same as it once was. Consumers aren’t just looking to live as long as possible; they’re looking to live better longer in a new era dubbed as the ‘healthspan era.’ The forefront of healthspan is giving consumers greater control over their future wellbeing largely with nutrition as the central focus,” said SPINS Senior Director of Market Insights Scott Dicker in a special “Active Aging” edition of Whole Foods Magazine.

“One of the biggest contributions to healthspan, beyond food and beverages, is the increase in personalization around active nutrition. Technology like wearables gives consumers real-time updates on their own health data — allowing them to make health choices unique to their own personal needs. From tracking dietary deficiencies to sleep patterns, wearable technology trades ‘one-size-fits-all’ style solutions for tangible individual health plans,” Dicker added.

Newly emerging healthcare companies like Love.Life, founded by former executives of Whole Foods Market, are leading the charge in blending natural wellness with medical services geared toward optimizing one’s healthspan.

"Love.Life aims to transform the lives of millions of people," said CEO and co-founder John Mackey at the launch of Love.Life in July 2023. "The conventional medical system is fundamentally flawed, focusing on managing diseases and treating symptoms rather than prevention and finding the root cause. Studies show that 80% of chronic diseases can be prevented and reversed through diet and lifestyle changes, which are the focus of Love.Life's philosophy and are rarely included in conventional treatment plans." Through tele-health and concierge services and walk-in wellness centers, Love.Life’s stated goal is to “help people lead long, healthy, and vibrant lives by improving both lifespan and healthspan.”

XPRIZE Healthspan: A $101 Million Global Competition

The quest for healthy aging is serious business, so much so that in July 2024, teams began competing in XPRIZE Healthspan, a seven-year, $101-million global competition to revolutionize the way we approach human aging, the goal of which is to “advance proactive, accessible therapeutic modalities that reduce the risk of chronic age-related diseases, increases human health span and extends quality of life well into our later years,” say the XPRIZE organizers.

A trustee of XPRIZE Healthspan, Ken Dychtwald, Ph.D., a psychologist, author of numerous books on aging, and CEO of Age Wave, has emerged as one of the world’s foremost visionaries regarding the lifestyle, marketing, healthcare, economic and workforce implications of aging. In an interview on Michael Krasny’s Grey Matter podcast in December 2023, Dychtwald said, “How many of your years are you healthy, vital, active, productive, vs. are you beginning to fall apart? We are 68th in the world when it comes to our healthspan in the U.S. What we all want is to live long and to live well and to not have the suffering and falling apart stretched out,” he said.

“Quality of life is what it is all about. We need to hold a mirror back to our own approach to healthcare and realize that we don’t take good care of our bodies, we eat a lot of junk food, two thirds of the population is overweight; we have a medical system that is all over the place, we have pharma industries and insurer industries making all kinds of money; we have a profit oriented system; we don’t even have geriatric competencies as a key variable among doctors, physical therapists, providers, etc.”

Dychtwald continued: “In a youth era, we assume that young people have hopes and dreams and you either achieve them or you don’t and then time’s up. But if you’re going to be living in a new era, a new age of aging, you might have new dreams at 70. You might have your biggest dreams beyond when you ever thought it was possible and we’ve got to open up the door to those possibilities. And so purpose is less a matter of simply hanging on for many people; for a growing number of people, it’s about discovering what their new purpose might be in their later years. Having done away with many acute and infectious diseases with things like penicillin, what are the breakthroughs we now need in healthcare so that we and our children and grandchildren can live long healthy lives?

Steven Hoffman is Managing Director of Compass Natural, providing public relations, brand marketing, social media and strategic business development services to natural, organic, sustainable and hemp/CBD products businesses. Contact steve@compassnaturalmarketing.com.

State of Natural: Industry on Track to Reach $318.6B in Sales in 2024 and $386.4B by 2028

This article first appeared in the November 2024 issue of Presence Marketing’s newsletter.

By Steven Hoffman

The natural and organic products industry is on a solid growth curve, supported by rising consumer demand for better for you products, according to the editors of Nutrition Business Journal (NBJ).

Surpassing $300 billion in sales on 4.8% growth in 2023, NBJ projects sales of natural, organic, regenerative and sustainable products in the natural channel will continue to grow at about 5% per year to reach $318.6 billion in 2024, and $386.42 billion by 2028, with the market “showing no signs of slowing down.”

Dominated by the natural and organic food and beverage sector, which commands three times the market share of supplements and seven times that of the natural living category, “the natural products industry has infiltrated every part of brick-and-mortar and online retail and is outpacing conventional products’ growth. Slow and steady is winning this race,” reported the NBJ editorial team in its State of Natural Report: Four-Year Forecast, 2024 - 2028, published in September 2024.

Sales of natural, organic and functional food and beverages account for 69.3% of the overall natural products market. According to NBJ, this category will continue to dominate the market, predicting that sales will grow to $220.78 billion in 2024, and will reach $265.2 billion in sales in 2028. Strong growth in this sector is driven by improved product quality and taste, global flavors, and plant-based, paleo and carnivore diet trends, among others.

According to NBJ, the majority, or 63.7% of natural and organic food and beverage sales are occurring in mass market retail stores, a trend that will continue as natural products become more accessible across the country. Traditional natural food retail stores command 28% of the natural and organic food and beverage market.

Supplements: The Roller Coaster Ride Is Over

For the dietary supplements category, “the roller coaster ride is over,” NBJ reported. “After a sobering deflationary period following stratospheric growth during the Covid-19 pandemic, the supplements industry is settling into steady, stable growth in every category. With the combined Sports Nutrition and Meal Replacements category and Herbs and Botanicals leading the way, supplements are projected to grow at around 5% each year through 2028, from $67.43 billion in 2024 to $82.81 billion. Many consumers who discovered supplements in their panicked searches for immunity hacks during the pandemic appear to be sticking with the vitamins and herbs they started taking, and the industry is mainstreaming as a result,” said NBJ.

While sports nutrition and meal replacements are projected to grow between 5% and 7% over the next four years, sales of vitamins and minerals, which took a post-pandemic hit (NBJ predicts growth of only 2.1% in this category in 2024), are projected to grow 3.7% in 2028. However, vitamins and minerals control the largest market share (30%) among the dietary supplement categories.

Herbs and botanicals are projected to be the fastest growing supplement sector, and annual growth will reach 7% by 2028. Market share for sports nutrition and meal replacements is expected to remain steady over the next four years, ranging between 26% and 28%. Herbs and botanicals, too, are predicted to maintain a steady market share of about 20% over the next four years.

NBJ also noted that in the dietary supplements category, in particular, direct to consumer channels are driving significant growth. “With annual growth between 6% and 7% — nearly triple that of Natural and Specialty—the Direct-to- Consumer channel is driving growth during the forecast period, while Natural and Specialty continues to lose market share, falling from 26% in 2024 to 23.2% in 2028,” NBJ predicted.

Natural Living: Small but Growing Fast

As consumers learn more about the dangers of environmental toxins, microplastics and ingredients used in conventional beauty care products from mainstream media, social media influencers and others, they are becoming increasingly aware of the fact that it’s not just what you put in your body, but also what you put on your body. While the Natural Living sector takes up the smallest slice of the natural products industry pie at a 9.5% market share, it is expected outpace overall industry growth, growing at 6% per year from $30.38 billion to an estimated $38.41 billion in sales in 2028.

According to NBJ, the natural and specialty channel is projected to lose market share of natural living products between 2024 and 2028, but it will remain the second largest channel behind mass market. By 2028, sales of natural living products in mass market will be more than double those of natural and specialty. Also, while mass market and e-commerce are driving much of the natural living market, practitioners and multi-level/network marketing “are the only channels projected to see increased growth throughout the forecast period,” said NBJ.

The principal analysts, authors and editors of the Nutrition Business Journal State of Natural Report: Four-Year Forecast, 2024 – 2028 were market research analyst Erika Craft, industry analyst Christian Irwin, senior editor Robyn Lawrence, managing editor Hannah Esper and content & insights director Bill Giebler. Sources for the data include SPINS, IRI Group, Natural Foods Merchandiser Magazine, New Hope Network and others. The report is available for $125.

Learn More

Nutrition Business Journal State of Natural Report: Four-Year Forecast, 2024 - 2028

Presence News: Natural Products Industry Reaches $303.3 Billion in Sales in 2023 on 4.8% Growth

Steven Hoffman is Managing Director of Compass Natural, providing public relations, brand marketing, social media and strategic business development services to natural, organic, sustainable and hemp/CBD products businesses. Contact steve@compassnaturalmarketing.com.

U.S. Organic Product Sales Near $70B; All-Organic Trade Show Set for 2025

By Steven Hoffman

Is it true that the growth rate in sales of certified organic bananas is now outpacing that of conventional bananas? According to the Organic Trade Association (OTA), the answer is yes.

In fact, among an ever-expanding sea of certification seals in the retail sector, and despite inflation, the “Certified Organic” label continues to stand out for consumers who prioritize health, sustainability and clean-label products. So much so that U.S. sales of certified organic products grew 3.4% in 2023 to $69.7 billion, marking a new record for sales in the organic products industry.

According to the OTA, which conducted the 2024 Organic Industry Survey in collaboration with Nutrition Business Journal, organic food sales in 2023 totaled $63.8 billion, and sales of organic non-food products reached $5.9 billion, with organic personal care products reporting the strongest increase in that category, with growth of 7% in 2023.

On the food side, fresh organic produce continues to dominate as the primary entry point for consumers, who are increasingly knowledgeable about the “Dirty Dozen” — those fruits and vegetables the Environmental Working Group has determined to contain the most synthetic pesticide residues. In 2023, sales of organic produce grew 2.6% to $20.5 billion. Top sellers included avocados, berries, apples, carrots and packaged salads. OTA also noted that, indeed, in 2023, organic bananas recorded greater sales growth than non-organic bananas.

Organic Baby Food Drives Growth in Grocery

The second biggest selling category in the organic sector in 2023 was grocery, comprising breads and grains, condiments, and packaged and prepared foods. Among a diverse group of sub-categories in grocery, three stood out as top performers: in-store bakery and fresh breads, with sales of $3.1 billion and growth of 3%; dry breakfast products, which were up 8% to $1.8 billion in sales; and organic baby food and formula, up an impressive 11% to record $1.5 billion in sales in 2023.

According to the OTA survey, 2023 also saw a surge in functional and non-alcoholic beverages, which helped drive beverages as the third largest category in organics, posting growth of 3.9% and sales of $9.4 billion. In addition to the emergence of organic “mocktails,” organic wine sales were up 2.5% to $377 million, and organic liquor and cocktails showed strength as an emerging category with growth of 13% and sales of $59 million in 2023.

Organic dairy and eggs, the fourth-largest category in the organic food market, based on OTA’s survey, is another entry point for consumers who want clean, ethical sources of protein with lower environmental impacts. In 2023, organic dairy and egg sales were up 5.5%, totaling $8.2 billion. According to OTA, organic dairy and eggs now account for more than 8% of all dairy and egg sales. Milk and cream sales were up nearly 5% to $4.2 billion. Also, the organic dairy alternative category grew almost 14% in 2023 to approximately $700 million.

Leading among organic non-food items were organic supplements, tracking 4% growth and sales of $2.1 billion in 2023. Organic fiber remains the largest segment of U.S. organic non-food product sales, representing 40%, or $2.4 billion, of non-food category sales. According to OTA, growth in organic fiber sales was essentially flat year over year, due to restricted supply chain issues more than lack of buyer interest.

Price Gap Is Narrowing Between Conventional and Organic

According to OTA Co-CEOs Matthew Dillon and Tom Chapman, the increase in overall dollar sales in the organic market in 2023 was driven more by price increases than unit sales as the organic industry recalibrated its supply chain and dealt with retail price increases as necessary. However, they pointed out, consumers increased their purchases of many organic products, and unit sales were up for nearly 40% of the products tracked in this year’s survey.

In addition, the survey indicated that prices for many non-organic products climbed at a faster rate than organic products, meaning that the price gap is narrowing between conventional and organic, which, says OTA, should fuel growth for organic products in the coming year.

“It is encouraging to see that organic is growing at basically the same rate as the total market. In the face of inflation and considering organic is already seen as a premium category, the current growth shows that consumers continue to choose organic amidst economic challenges and price increases. Although organic is now a maturing sector in the marketplace, we still have plenty of room to grow,” said Tom Chapman.

Matthew Dillon added that to achieve this growth, “It is essential to educate consumers that choosing organic is a straightforward way to tackle some of the greatest challenges we face. Whether it's accessing healthy foods, improving transparency in supply chains, mitigating climate change, supporting rural economic resilience, protecting natural resources, or realizing the multitude of other benefits, effectively communicating and delivering on these promises is the key to expanding organic’s share of our dinner plate.”

The future for organic is not without its challenges. However, Chapman and Dillon assert that more consumers are aware of the potential health benefits associated with organic foods. Many consumers, too, especially the Millennial and Gen Z generations, they point out, are increasingly conscious of the ethical implications of their food choices. They are looking for products that align with their values, such as animal welfare, fair trade, and support for organic farmers. That means seeking out products with the USDA certified organic seal on the label.

OTA Members can download the full report here. A summary is available here.

Dedicated All-Organic U.S. Trade Show Announced

Since 1991, people from all over the world have attended, BioFach, the world’s only dedicated, all-organic trade show, held each year in Nuremberg, Germany. Now, targeting the world’s largest market for organic products, the producer of BioFach has announced it will host its first standalone, all-organic trade show in the U.S.

Dubbed BioFach America, the event will take place on June 2-4, 2025, in Atlanta.

“With BioFach America, we will host a purely organic trade show in the US. The whole organic value chain will be covered: from organic farming to retail,” said NürnbergMesse, producer of the event. According to the producer, every product presented at BioFach America must be USDA certified organic or carry an organic certification from an IFOAM Organics International accredited organization. For cosmetics, certifications such as COSMOS or Ecocert, are accepted.

In an interview with Organic Insider, Bill Ingwersen, CEO of NürnbergMesse North America, said, “BioFach America always had a presence, or section, at Natural Products Expo East, and last year in Philadelphia, we brought in 47 companies from around the world. With that show being canceled, it forced us to really ask the question: are people getting what they need at other shows or is there a true need for an organic one? We concluded that there was, in fact, a real need for a dedicated, all-organic platform in the U.S.”

When asked why Atlanta was chosen as the location for the inaugural event, Ingwersen told Organic Insider, “Since this is a U.S. show and not a regional one, people will have to travel, regardless of which city we chose. After many conversations with industry executives, it became clear that we had to make it an affordable show for everyone, including farmers. Atlanta has the world’s largest airport, has an ample supply of low-cost hotel rooms and is a very energetic, accessible city that has great infrastructure. In addition, it can support our growth as we move forward. Also, being able to serve an organic lunch to our attendees was a real hot button topic. All the catering coming out of the Atlanta Convention Center will be organic for the show, and if a city could not guarantee this, that was an immediate disqualification.”

Learn more about BioFach America here.

AI Leads Tech Transformation in Natural Foods

This article first appeared in Presence Marketing’s August 2023 newsletter.

By Steven Hoffman

While 2023 may not be the year the singularity took place, with the launch of the first user-friendly artificial intelligence (AI) chat bot, ChatGPT, it could well go down in history as the Year of AI.*

From regenerative organic agriculture and nutrition research to product development, marketing, distribution and retail operations, business leaders in the natural channel are already finding multiple uses for this nascent yet transformative technology. A growing number of natural and organic products companies are taking the lead in employing AI automation, and such uses across the supply chain are growing as exponentially as the technology upon which it is based.

For the grocery industry, AI is projected to generate $113 billion in operational efficiency and new revenue by 2025. In a June 2023 study by data analytics firm Grocery Doppio, conducted in partnership with FMI – The Food Industry Association, and based on interviews with 152 grocery executives, implementation of artificial intelligence in supermarkets is expected to grow by 400% by the end of 2024. In addition AI “could eliminate 18% of store associate positions, 73% of store tasks and 53% of shopper queries,” reported Winsight Grocery Business.

AI adoption will deliver $113 billion in operational efficiency and new revenue opportunities for the grocery industry by 2025. Source: The Times They Are A-Changing: Impact of AI in Grocery. Source: Grocery Doppio

According to Grocery Doppio’s findings, inventory management savings could account for more than half of the estimated $113 billion in value. AI also will help grocers save billions in merchandising costs through advancements in product assortment and pricing optimization. Other savings include marketing, store operation costs, and IT technology.

While AI is not necessarily a new area for the grocery industry, grocers are focusing more on the “responsible, ethical use” of artificial intelligence,” said Mark Baum of FMI in a July 13th, 2023, Grocery Dive report. One quarter of retailers and more than a third of suppliers are using artificial intelligence (AI) to track product preferences and spending to anticipate consumer wants and needs, according to FMI’s 74th annual survey, The Food Retailing Industry Speaks 2023. “Every CEO needs to at least think like a CIO, if not act like a CIO, going forward. We’d like to say these days if you’re not technology enabled, you’re competitively disadvantaged,” Baum said.

Yet, a major concern among grocery and other workers is that AI could automate or partially automate up to 300 million jobs over the next decade, according to a study by Goldman Sachs. The industries most impacted by AI-driven automation will be “office and administrative support” and “legal.” However, according to Goldman Sach’s findings, “Once AI is implemented, workers will be more productive leading to an overall increase in output. This could lead to a 7% increase in annual GDP, equivalent to an astounding $7 trillion.”

Read on to learn how some early adopters in the natural and organic products industry are making innovative use of AI technology.

Research and Product Development

Dietary supplement companies have been utilizing AI to speed up the research of nutritional compounds. Companies like Brightseed employ machine learning to develop bio-active phytonutrient compounds to support gut health. Supplement maker Nuritas, recipient of Nutrition Business Journal’s 2023 Science and Innovation Award, employs artificial intelligence to identify “novel health-benefitting ingredients” and “the best plant-sourced, cell-signaling peptides,” said Nuritas founder Nora Khaldi.

In a July 2023 podcast, The Natural List, Aadit Patel, VP of Product Engineering at NotCo, a plant-based food technology company, shared how it uses AI and “the right balance of technology and humanity” to bring novel plant-based meat and dairy alternatives to market.

In related news, researchers at Northeastern University have developed an AI algorithm, FoodProX, that can predict the level of processing in food products and if a food has been “ultra-processed.” Such information is important for researchers in examining the health impacts of processed foods, Neuroscience News reported in June 2023.

Marketing

In an in-depth interview in Strategy Magazine, Arjan Stephens, President of leading organic food manufacturer Nature’s Path, shared that AI helps the company deal with inflation and competition by creating more targeted messaging in a quicker timeframe.

“The aim is to educate consumers on our commitment to fueling healthy communities as well as the inherent value of supporting and investing in a triple bottom line business like ours. A.I. has been a huge part of driving efficiencies in getting more strategic content to market more quickly. It not only enables us to swiftly create and distribute content, but to also respond more efficiently to consumer feedback and shopping behavior changes. This will continue to be critical to competing in a market that is oversaturated in greenwashing and misinformation,” Stephens said.

Distribution

Distributors, in particular, are looking to AI – and even AI-powered robots – to optimize supply chain and transportation logistics. Leading natural foods distributor UNFI in June 2023 announced a partnership with Finnish firm RELEX Solutions. Driven by AI and machine learning, RELEX will work with UNFI to consolidate and replace multiple UNFI buying systems into “one enhanced process, combining a more robust analysis of demand with a more granular approach to procurement,” UNFI said in a statement.

UNFI’s new AI platform is expected to become operational over the next 12 to 18 months. “As part of UNFI’s multi-faceted transformation agenda, we’re continuing to implement cutting-edge technology to improve the customer and supplier experience, while increasing operating efficiency,” said Erin Horvath, Chief Operating Officer at UNFI. In March 2023, UNFI announced that it would utilize robots powered by artificial intelligence and software automation and new scanning technology at its distribution center in Centralia, Washington.

Grocery wholesale cooperative Associated Food Stores (AFS) also plans to deploy robotics and AI-powered automation technology at is distribution center in Farr West, Utah, according to a May 9th, 2023, report in Winsight Grocery Business. Working with technology company Symbotic, AFS’s end-to-end automation system will include robotic case-pick capabilities “to enhance a range of retail-facing experiences,” including supply, expanded assortment and product delivery to stores.

Seeking to disrupt the traditional natural products distribution sector, Pod Foods claims it offers the first truly “infinite” warehouse for food procurement in the industry while providing retailers with data-driven, relevant access. The engine is powered by the company’s “Pod Bytes” data platform, which synthesizes data from its B2B marketplace, economic indicators, and other grocery-adjacent and third-party sources, the company said. The built-for-grocery models provide retailers with personalized, AI-enabled insights across all areas of discovery, including product placement, procurement, inventory optimization and market opportunity. The result is access to an endless yet personalized assortment of products, targeted to each retailer based on consumer purchasing behavior, desired retail margins, local trends, and more, the company says. Pod Foods in April 2023 appointed former VP executive and CPG veteran Michael Schall as President.

Retail

At The Fresh Market, which operates 160 stores in 22 states, longtime marketing partner Firework is implementing a patent-pending artificial intelligence platform to enhance The Fresh Market’s video content for consumers. The technology will allow shoppers to ask questions and receive sophisticated, real-time answers in The Fresh Market’s in-video chat feature. Viewers will be able to ask such questions as, “What is the recipe for the salad being made in this video?” and the AI chatbot will list the ingredients.

“The new AI engine makes use of a large language model (LLM), can understand and respond in a wide range of languages, and can be customized to reflect each brand’s unique voice,” The Fresh Market said in a statement. The new technology will be available on The Fresh Market’s website and its shoppable video live commerce retail media network. “Our customers are looking to engage with our brand in real time, both online and in store. With Firework’s generative AI technology, we can be certain that customers will receive prompt, friendly and personalized support whenever they choose to engage with our video commerce content,” said Kevin Miller, CMO at The Fresh Market.

Shoppers at Sprouts Farmers Market can now use an AI-based shopping assistant called Quin. The phone-based app from New York-based developer Verneek can answer spoken or typed questions about items sold in the stores and provide information about recipes, keto-friendly options, nutritional value and more. “As technology continues to evolve, Sprouts is always exploring new and innovative ways to improve our customer experience while providing joy in healthy living,” Sprouts said in a statement. Nasrin Mostafazadeh, Cofounder of Quin, said in ArcaMarx Magazine in April 2023 that the timing was right to launch Quin in grocery stores. However, he noted, Quin is not intended to replace grocery workers but to supplement them, giving them more time to focus on their job responsibilities, such as stocking shelves, doing inventory or checking out customers.

On THRIVE Market’s blog, the online retailer helps customers evaluate the best AI recipe generators. “There are now lots of websites that use AI machine learning to populate recipes based on ingredients, dietary restrictions, and even cooking skill level,” wrote THRIVE blogger Amy Roberts. “Some create a recipe based on ingredients you have on hand, while others churn out a recipe based on a query, like ‘Make a gluten-free chicken parmesan.’” Roberts reviewed ChatGPT for a vegan cheesecake recipe, Let’s Foodie for a red cabbage slaw, and PlantJammer for lasagna. “Did it work?” Roberts asked. “Surprisingly yes! The cheesecakes were a hit!” Though, Roberts admits she continues to refer to Pinterest for her own recipe ideas.

Using an organic food store as an example, AI platform Business Name Generator cites the following case study: “Consider the case of a budding entrepreneur, John, who planned to start an organic food store. He wanted a name that conveyed freshness, health, and sustainability. After struggling with brainstorming sessions, he turned to an online business name generator. He entered keywords such as ‘organic,’ ‘fresh,’ ‘healthy’ and ‘green.’ In seconds, the tool provided him with a list of potential names like ‘Freshly Organic,’ ‘Green Harvest,’ “Healthful Bounty’ and ‘SustainaBite.’ John was able to choose a unique and meaningful name for his store.”

Agriculture

For regenerative and organic farmers, AI technologies including machine learning and data analytics are being used to develop sophisticated monitoring systems that can provide farmers with real-time information about factors that affect soil health, including nutrient deficiencies and moisture levels. Combined with the use of sensors, drones and satellite imagery, AI algorithms are being used to analyze massive amounts of data to determine the optimal amount of water needed for each crop, reducing water waste, and ensuring that plants receive necessary nutrients for healthy growth. This not only conserves water resources but also helps to prevent soil degradation caused by overwatering, reported Marcin Frackiewicz in TS2 in May 2023.

At the University of California Davis, the AI Institute for Next Generation Food Systems (AIFS), funded in part by USDA, was launched in 2020 with a mission of meeting growing demand in the food supply by increasing efficiencies using AI and “bioinformatics” spanning the entire system from seed to shelf. Bringing more than 40 researchers together, AIFS says it aims to “bring artificial intelligence technology to the entire food system from crop breeding and farming to food production and nutrition. The institute will combine the development of the latest breakthroughs in artificial intelligence with preparing the food and agriculture industries to rapidly adopt them and ready the workforce.”

In addition, leading technology companies including IBM, Microsoft, Intel and others are focusing on developing artificial intelligence for use in agriculture and food production. Microsoft’s Project FarmVibes seeks to foster sustainable agriculture by collecting and analyzing data in from drones, sensors and other equipment to help farmers make real-time decisions about their crops. Intel and the National Science Foundation in 2022 invested $220 million in a number of AI ventures, including research in AI-Driven Innovation in Agriculture and Food Systems. Focusing on regenerative agriculture, IBM in 2022 launched IBM Regenerative Agriculture, which uses AI, data analytics, cloud technology and predictive insights to interpret agricultural and weather data and help farmers make decisions about crops.

“The food chain is a complex ecosystem that touches our everyday lives, and this is where AI has an advantage – by navigating the complex web of information, from farming to food distribution,” said Bryton Shang, CEO of Aquabyte in Forbes in July 2023. “It can help ensure higher-quality decision-making every step of the way.”

* Written and researched by a real human, with 40+ years’ experience in natural and organic foods and sustainable agriculture.

Steven Hoffman is Managing Director of Compass Natural, providing public relations, brand marketing, social media, and strategic business development services to natural, organic, sustainable and hemp/CBD products businesses. Compass Natural serves in PR and programming for NoCo Hemp Expo and Southern Hemp Expo, and Hoffman serves as Editor of the weekly Let’s Talk Hemp Newsletter, published by We are for Better Alternatives. Contact steve@compassnaturalmarketing.com.

Natural & Organic Industry Set to Surpass $300 Billion in Sales in 2023, Despite Slower Growth, Inflation

This article first appeared in Presence Marketing’s May 2023 newsletter.

By Steven Hoffman

The U.S. natural and organic products industry is on pace to surpass $300 billion in total industry sales in 2023, despite slower growth and inflation, according to early estimates by Nutrition Business Journal.

Presenting the data at Natural Products Expo West in March, New Hope Network SVP and Market Leader Carlotta Mast said, “This would represent a doubling of industry sales over the last decade. That’s huge. We are a sizeable, impactful, meaningful industry. We’re not a fad anymore. We’re not this niche industry.”

U.S. consumer sales of natural and organic products reached $278 billion in 2022, with growth slowing from 7% in 2021 to 5.4% in 2022, according to preliminary research by Nutrition Business Journal, based on data provided by market research firm SPINS. This follows an unprecedented spike of 10% growth in 2020, as a result of the pandemic. Sales growth is expected to recover somewhat going forward, according to Mast, and is projected to reach 6% in 2024 and 2025.

The bulk of the growth in 2022 was driven by natural, organic and functional food and beverage sales, led by carbonated drinks, dairy alternatives, “better-for-you” sweeteners, baby products and canned and dried soups. These categories outperformed the overall natural and organic products industry, Mast noted. In functional foods and beverages, sports and energy drinks, soft drinks, frozen desserts and snack chips that include functional ingredients such as mushrooms, adaptogens, electrolytes, prebiotics and healthy fats helped drive sales in the category.

Hitting a milestone in 2022, as well, were sales of organic food and beverage products, with sales estimated at more than $50 billion. According to Mast, this figure represents a doubling in organic food and beverage sales since 2014. Product categories that performed strongly in the organic sector last year included organic baby formula, candy, dips, soft drinks and yogurt, according to New Hope and SPINS data.

However, after seeing record growth in 2020, most impacted by inflationary pressures was the dietary supplements category, which rose only 1.7% in 2022 to $60.9 billion in sales, based on the data presented at Expo West and reported on by Food Navigator-USA.

Kathryn Peters, Chief of Staff at SPINS, shared with attendees at Expo West that natural and organic foods are continuing to expand into the mainstream, with sales of natural products in conventional grocery and convenience outpacing growth in traditional natural food stores. Growth in sales of natural products in 2022 increased 9.2% in convenience, followed by a 7.4% increase in “conventional multi-outlet,” and a 4.1% increase in regional grocery, compared to 2.5% growth in the natural channel, based on SPINS data and reported by Food Navigator-USA.

While shoppers continue to look for deals and best prices across multiple channels including supermarkets, mass retailers, club stores and online to help reduce the impact of higher food prices, according to The Hartman Group and FMI — The Food Industry Association, 32% of shoppers concerned about rising food prices reported buying fewer items as a strategy to save money in February 2023. That’s down from 41% of shoppers who reported buying fewer items to save on food costs in October 2022.

“Our national survey reveals persistent consumer concern about food and beverage prices, as the weekly spend for groceries increased in late 2022 and early in 2023,” Leslie G. Sarasin, president and CEO of FMI, said in a statement. “To address higher prices, shoppers are visiting more stores and seeking deals to stretch their dollars but are now less likely to cut back on the number of items purchased compared to six months or a year ago. This is an opportunity for our industry to continue connecting with shoppers on food-inflation-mitigating solutions.”

According to FMI and The Hartman Group’s findings, food price concerns cut across shopper demographics, however, “Boomers are more worried about rising food prices than any other group, with 80% showing concern in February 2023 versus 69% in October 2022. Millennials polled close behind with 76% saying they are concerned, 5% more than one year ago. Such concerns about food costs coincide with an increase in spending in this inflationary environment. In February, on average, consumers spent $164 per week on groceries, up from $148 in both October and February of 2022,” FMI said.

Natural and organic food shoppers, in particular, may be less sensitive to price than traditional shoppers, but they still want quality, taste, nutrition, value … and sustainability. Younger consumers are driving demand toward brands that reduce waste and minimize carbon footprint and environmental impact. “The values-oriented shopper is a really important and valuable shopper,” Peters of SPINS noted, and according to Nutrition Business Journal, organic products are one of the last places consumers say they are willing to trade down to fight food inflation.

In a Chicago Tribune feature article published on April 3, 2023, Tonya Lofgren, Marketing Manager of Ciranda, a leading organic ingredient supplier based in Hudson, WI, said, “What’s cool about the natural and organic shopper is that if they value that, they’ll prioritize it over other ways to adjust spending because they realize how important it is.” Ciranda CEO Doug Audette added, “We are seeing consumers rationalizing their spending decisions. Overall, that has tempered the growth in organic. But we see no letting up in the long-term growth of organic, sustainable and fair-trade ingredients.”

In a March 2023 organic market report, USDA reported that, after a surge in pantry stocking pushed sales to record heights in 2020, organic food sales declined for the first time in decades in 2021 on an inflation-adjusted basis. However, “more than 15 million new customers entered the organic and natural foods market between early March and mid-April 2020,” USDA said. Time will tell if these consumers stick with organic.

According to USDA’s market report, organic consumers are diverse in terms of race, ethnicity, education, and income, though millennials purchase organic food at larger rates than other generations. Households with children are also more likely to purchase organic food than households without children, USDA noted.

Yet, challenging new and dedicated organic consumers alike is the fact that organic foods are seeing some of the steepest price hikes amid stubbornly high food inflation. Prices for organic fruit and vegetables rose 13.1% over the past year, compared with just under 10% for conventional produce, according to a February 2023 analysis of USDA retail pricing data by Lending Tree.

Among all the food groups included in Lending Tree’s analysis, organic chicken prices increased the most, at 19.5%. “That's more than three times the price jump for conventionally raised chicken, which rose 5.9% over the last year, the report shows. For households already struggling with the nation's worst bout of inflation in 40 years, such spikes could force many consumers to opt for nonorganic options instead,” CBS News reported.

Sales data for 2022 show organic fruits and vegetables growing in revenue but declining in sale volume, according to the Organic Produce Network. However, that’s a common theme across the food industry as consumers pay more for less in the face of heavy inflation, the Chicago Tribune noted.

According to the Tribune, a quarter of consumers surveyed by Nutrition Business Journal over the past year said they’re unlikely to stop buying organic produce, packaged food and meat to save money on groceries. Fewer than half of respondents said they are likely to cut those products out.

Steven Hoffman is Managing Director of Compass Natural, providing public relations, brand marketing, social media, and strategic business development services to natural, organic, sustainable and hemp/CBD products businesses. Compass Natural serves in PR and programming for NoCo Hemp Expo and Southern Hemp Expo, and Hoffman serves as Editor of the weekly Let’s Talk Hemp Newsletter, published by We Are for Better Alternatives. Contact steve@compassnaturalmarketing.com.

Survey Says: Research Shows Natural, Organic Channel Saw Steady Growth in 2021

This article originally appeared in Presence Marketing’s July 2022 Industry Newsletter.

By Steven Hoffman

Starting out in the natural and organic products industry in the mid 1980s as an associate editor with media and trade show company New Hope Network, there were a few long after-hours sessions spent each summer pouring over completed paper surveys sent in by retailers, and compiling data with company founder Doug Greene to analyze and publish what has since become a milestone marker for the industry, the Natural Foods Merchandiser’s Annual Market Overview Survey.

Photo Credit: Organic Trade Association

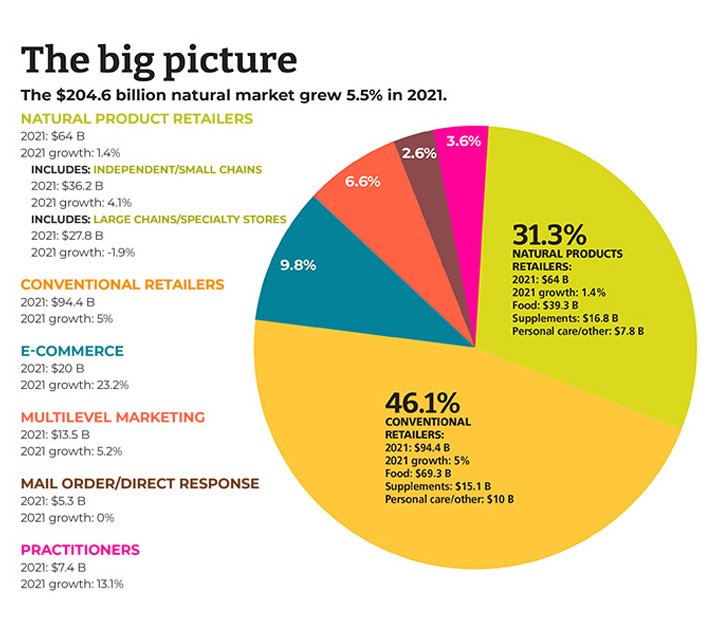

Today, the survey has become much more sophisticated, and so has the market, which has grown 10X since that time to reach $204.6 billion, representing an overall growth rate of 5.5% in 2021, according to this year’s report, published in June 2022.

Once dominated by independent natural products retailers, according to this year’s survey, conventional retailers now command 46.1% of natural products sales, representing growth of 5% in 2021. Combined, independent and large-chain natural products retailers comprised a market share of 31.3% in 2021. However, while independent natural products retailers recorded growth of 4.1%, the large chain and specialty store format saw sales decline by 1.9% in 2021.

Overall, conventional grocers reported natural products sales of $94.4 billion in 2021. Sales were $64 billion among natural products retailers in 2021, comprising independents, small chains and large chain/specialty stores. New Hope estimates there were 21,613 independent and large chain natural channel retail stores in the U.S. in 2021.

Of note, e-commerce sales of natural products continues to grab market share, charting growth of 23.2% in 2021. That’s not surprising, say industry observers, considering consumers were still spending considerable time at home in 2021 during the pandemic. Now, as the world emerges, some of those online consumer shopping behaviors may stick, according to Nutrition Business Journal’s 2022 Supplement Business Report, particularly when it comes to dietary supplement sales. According to NBJ, the supplement industry recorded $59.9 billion in sales in 2021, up from just $43.2 billion five years ago. E-commerce claimed the biggest share of post-pandemic dietary supplements sales growth, reported Rick Polito in the Natural Products Industry Health Monitor.

Photo Credit: Natural Foods Merchandiser 2022 Market Overview Survey, New Hope Network

Across all sales channels, e-commerce “is leading a huge shift in channel dynamics,” according to NBJ Senior Industry Analyst Claire Martin Reynolds. Based on a growth trajectory that is expected to add another $10 billion in dietary supplement sales over the next four years, “2024 is expected to be the record year where e-commerce market share in supplement sales is larger than natural and specialty or mass market retail, coming sooner than previously forecasted given the pandemic-related acceleration,” NBJ reported.

New Hope’s overview also revealed some interesting data regarding the demographic makeup of natural products shoppers.

While a common assumption is that natural channel shoppers are mostly white, well-off moms, that perception is inaccurate, said New Hope’s editors. “In fact, shoppers are fairly evenly divided along gender lines; fewer than half are Caucasian; about 40% are affluent; and more than a third live in households with just two people. Additionally, more than a quarter of natural channel shoppers are Hispanic and more than a third of Asian consumers are significantly more likely to shop at natural grocery stores; 36% of consumers who represent communities of color agree that products at natural retailers were, ‘made with me in mind’ (compared to 32% of all retail customers combined); and Hispanic and Asian consumers specifically are more likely than all natural retail shoppers to agree that they are ‘willing to pay a premium for natural and organic foods and products’ (44% vs. 36%),” New Hope’s researchers reported.

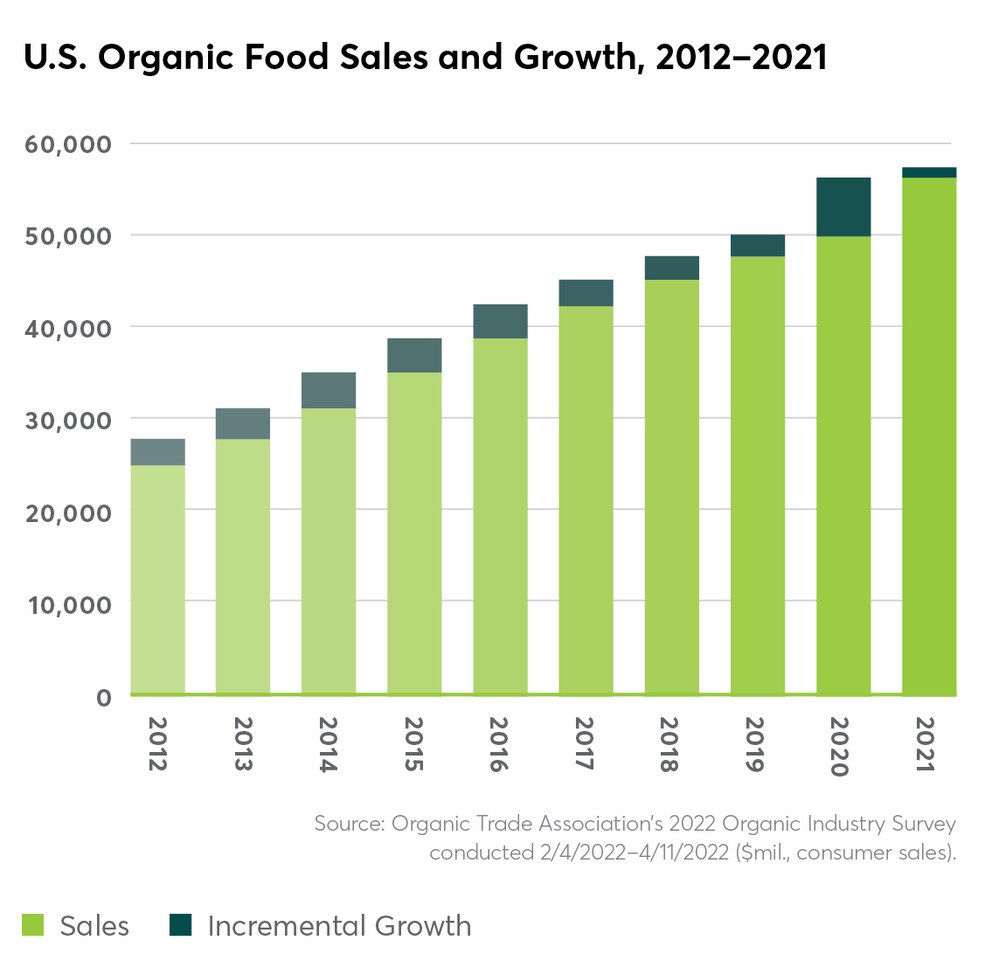

In related news, in its annual Organic Industry Survey, published in June 2022, the Organic Trade Association reported that between 2020 and 2021, sales of organic products surpassed $63 billion, growing 2% during that time period. Food sales, which comprises over 90% of all organic sales, rose 2% to $57.5 billion, and sales of nonfood organic products grew 7% to reach $6 billion in sales.

“Like every other industry, organic has been through many twists and turns over the last few years, but the industry’s resilience and creativity has kept us going strong,” said OTA’s CEO and Executive Director Tom Chapman, “In 2020, organic significantly increased its market foothold as Americans took a closer look at the products in their home and gravitated toward healthier choices. When pandemic purchasing habits and supply shortages began to ease in 2021, we saw the strongest performance from categories that were able to remain flexible, despite the shifting landscape. That ability to adapt and stay responsive to consumer and producer needs is a key part of organic’s continued growth and success.”

Among the strong performers in organic: organic beverages experienced the highest growth (8%) of all major categories, with organic coffee topping 5% growth and $2 billion in annual sales. Organic produce accounted for 15% of the organic products market, bringing in $21 billion in revenue in 2021, a 4.5% increase over 2020. Fresh produce drove growth in that category, at 6%.

While a decline in packaged and prepared organic food sales in 2021 represents a shift away from the pantry loading of 2020, organic baby foods — traditionally a strong entry point for shoppers new to organic — was a bright spot in 2021 with 11% growth. Organic snack foods, which suffered a decline in 2020, saw healthy growth of 6% in 2021, reflecting a return to active lifestyles and demand for healthy, nutritious on-the-go foods.

Among non-food organic products, fiber, supplements and personal care products were the most dominant performers with growth rates of between 5.5% and 8.5% in 2021, said OTA. Textiles, the largest non-food sub-category, represented 40% of the category’s total sales and brought in $2.3 billion in annual sales. Overall, non-food products saw 6% growth in 2021 and represented nearly $6 billion in sales, OTA reported.

However, industry observers caution that the unprecedented inflation the country is experiencing this year could affect sales of typically higher priced organic products as price-sensitive consumers opt for purchasing conventional foods to save money, according to a recent report in the Organic Produce Network. According to an Economist/YouGov poll taken in June 2022, 69% of Americans say changes in the inflation rate have impacted them negatively. In a June 2022 survey conducted by market research firm The Feedback Group, 24% of consumers are substituting similar, less expensive foods and 12% said they are buying fewer organic items and products to cut costs.

“Organic’s ability to retain the market footholds gained during 2020 and continue to grow despite unprecedented challenges and uncertainty is a testament to the strength of our industry and our products. To keep organic strong, the industry will need to continue developing innovative solutions to supply chain weaknesses and prioritizing efforts to engage and educate organic shoppers and businesses,” said OTA’s Tom Chapman.